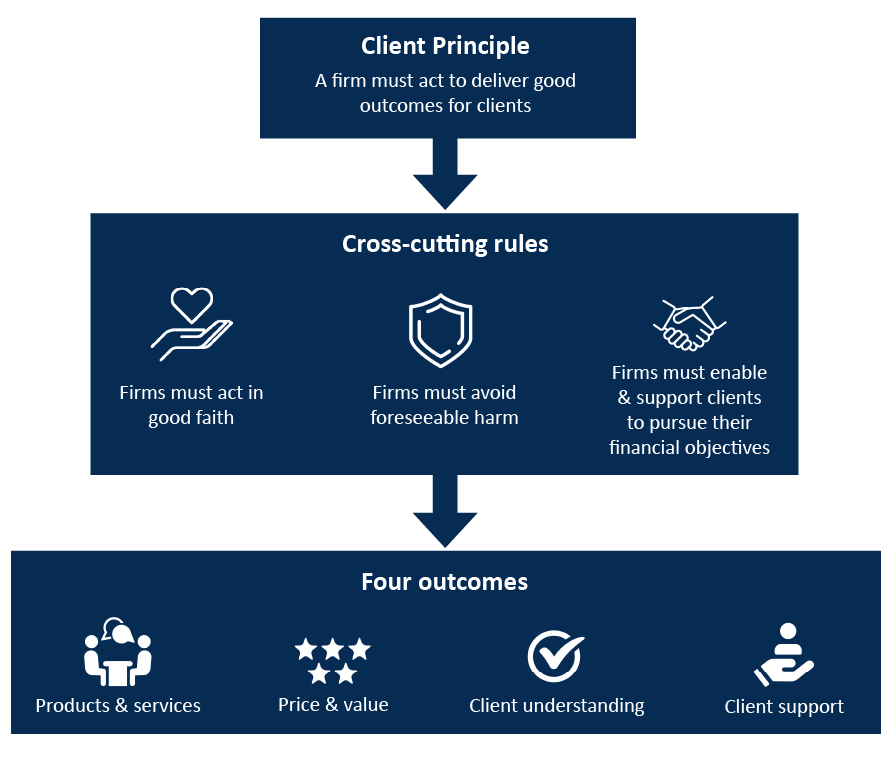

In August 2023 the Financial Conduct Authority (FCA) introduced new Consumer Duty legislation with a focus on ensuring fair value, providing products and services designed to meet client needs, delivering high levels of client service and improving consumer confidence and client understanding.

In August 2023 the Financial Conduct Authority (FCA) introduced new Consumer Duty legislation with a focus on ensuring fair value, providing products and services designed to meet client needs, delivering high levels of client service and improving consumer confidence and client understanding.

Over the last 4 decades we have worked tirelessly on these principles for our clients and both welcome and embrace an even greater spotlight being placed on our industry on achieving good financial outcomes for all.

Our mission is to enhance people’s lives by delivering peace of mind, enabling financial freedom and helping clients achieve their financial goals. We take great pride in leading the way in having these four key outcomes already well and truly embedded in how we look after our clients, both old and new, and continue to work relentlessly on our client experience and outcomes.

To see the full FCA legislation please visit: https://www.fca.org.uk/firms/consumer-duty

In August 2023 the Financial Conduct Authority (FCA) introduced new Consumer Duty legislation with a focus on ensuring fair value, providing products and services designed to meet client needs, delivering high levels of client service and improving consumer confidence and client understanding.

In August 2023 the Financial Conduct Authority (FCA) introduced new Consumer Duty legislation with a focus on ensuring fair value, providing products and services designed to meet client needs, delivering high levels of client service and improving consumer confidence and client understanding.