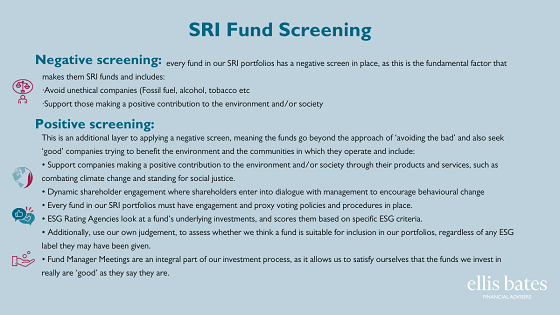

Negative screening: Our SRI portfolios avoid unethical companies, while supporting those making a positive contribution to the environment and/or society. Every fund in our SRI portfolios has a negative screen in place, as this is the fundamental factor that makes them SRI funds.

Negative screening: Our SRI portfolios avoid unethical companies, while supporting those making a positive contribution to the environment and/or society. Every fund in our SRI portfolios has a negative screen in place, as this is the fundamental factor that makes them SRI funds.

Positive screening: This is an additional layer to applying a negative screen, meaning the funds go beyond the approach of ‘avoiding the bad’ and also seek ‘good’ companies trying to benefit the environment and the communities in which they operate.

Positive screening: This is an additional layer to applying a negative screen, meaning the funds go beyond the approach of ‘avoiding the bad’ and also seek ‘good’ companies trying to benefit the environment and the communities in which they operate.

UN Sustainable Development Goals (SDGs): Every fund must be associated with one or more of the 17 SDGs so our clients can be confident that we are working hard to enhance the value of their investments, whilst contributing to a more sustainable world.

Meeting with fund managers: We meet with the managers of each fund before we invest. This is a key part of our process, as it allows us to satisfy ourselves that the funds really are as ‘good’ as they say they are.

Meeting with fund managers: We meet with the managers of each fund before we invest. This is a key part of our process, as it allows us to satisfy ourselves that the funds really are as ‘good’ as they say they are.

Culturally intrinsic: Each sustainable investment fund must have a socially responsible investment culture intrinsic to its approach. This helps us ensure that the funds are incorporating ESG factors into their mandates for the right reasons.

Culturally intrinsic: Each sustainable investment fund must have a socially responsible investment culture intrinsic to its approach. This helps us ensure that the funds are incorporating ESG factors into their mandates for the right reasons.

Proxy voting: Every sustainable investment fund must have engagement and proxy voting policies and procedures in place. We believe that active ownership plays a crucial part in an SRI strategy, as this dialogue between investors and companies positively influences corporate behaviours and improves transparency.

Proxy voting: Every sustainable investment fund must have engagement and proxy voting policies and procedures in place. We believe that active ownership plays a crucial part in an SRI strategy, as this dialogue between investors and companies positively influences corporate behaviours and improves transparency.