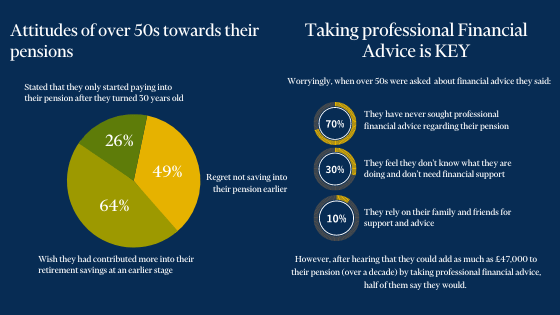

Financial advice percentages

https://www.ellisbates.com/wp-content/uploads/2022/06/FA-Graphic.png 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=gAttitudes of over 50s towards their pensions 26% – Stated that they only started paying into their pension after they turned 30 years old 49% – Regret not saving into…