The earlier you start retirement planning, the better. However, with the demands of managing a busy working and personal life, this is something that can understandably be neglected. But it’s never too late to think about saving for retirement – even if you are planning to give up work in just a few years’ time, you will have options to add to your nest egg.

How to plan for retirement

People planning for retirement should think hard about what they want to do when they eventually stop work. It is helpful to have a good idea of the lifestyle you want, how much it will cost and how you are going to pay for it.

With so much going on in your life – from family and work to pursuing your passions – retirement planning may not have been your priority. But now you want to make sure your pension and overall financial situation will allow you to keep up your current lifestyle. The more enthusiastic you are about retiring, the more likely you are to develop a robust retirement plan.

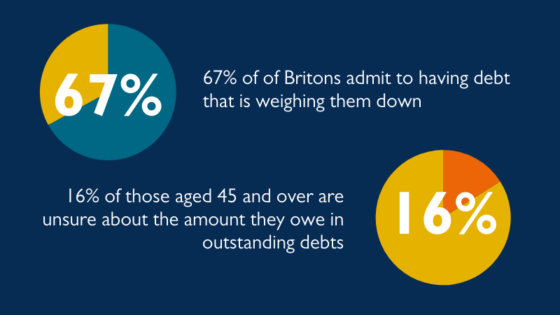

When it comes to retirement planning, there are a lot of things to consider. First and foremost, you need to make sure that you have enough saved up to cover your costs. This includes things like living expenses, health and care costs, and any other debts or financial obligations you may have.

You also need to think about how you want to spend your retirement years. Do you want to travel? Spend time with family and friends? Pursue hobbies or interests?

Whatever you want to do, it’s important to have a plan in place so that you can make the most of your golden years.

Last but not least, don’t forget to factor in inflation when planning for your retirement. Over time, the cost of living will go up as we’ve seen recently, so you’ll need to make sure that your savings can keep pace with rising prices.

By planning ahead and taking all of these factors into consideration, you can look forward to a comfortable and enjoyable retirement.

Of course, the answer to that question will depend on what you want to do when you stop work. Many believe they will be able to rely on the State Pension but worryingly only 53% knew that retirees receive £9,628 per year from their State Pension and this would be only a very basic standard of retirement living.

Of course, the answer to that question will depend on what you want to do when you stop work. Many believe they will be able to rely on the State Pension but worryingly only 53% knew that retirees receive £9,628 per year from their State Pension and this would be only a very basic standard of retirement living.