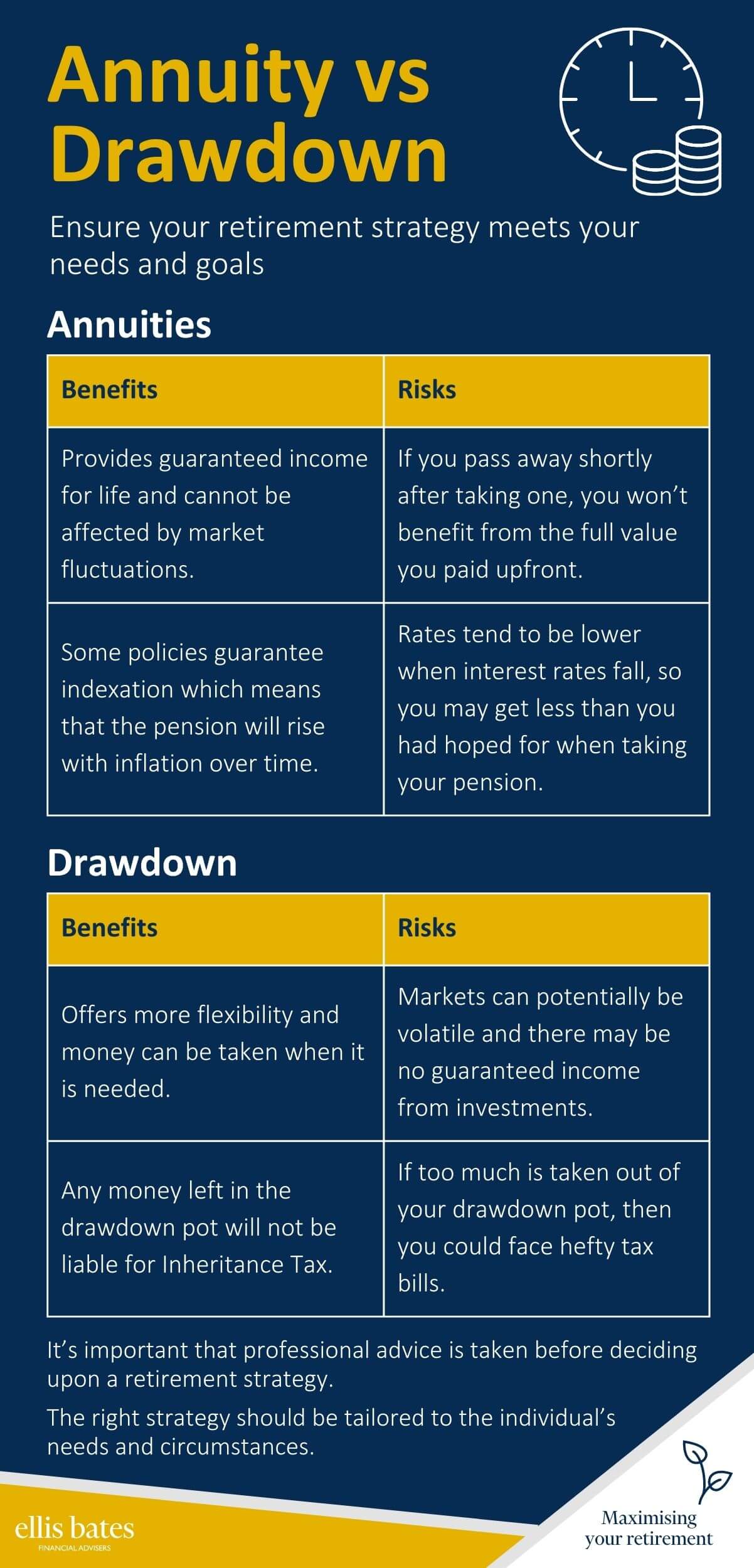

Ensure your retirement strategy meets your needs and goals

Pension annuities

| Benefits | Risks |

| Provides guaranteed income for life and cannot be affected by market fluctuations. | If you pass away shortly after taking one, you won’t benefit from the full value you paid upfront. |

| Some policies guarantee indexation meaning the pension will rise with inflation over time. | Rates tend to be lower when interest rates fall, so you may get less than you had hoped for when taking your pension. |

Pension Drawdown

| Benefits | Risks |

| Offers more flexibility and money can be taken when it is needed. | Markets can potentially be volatile and there may be no guaranteed income from investments. |

| Any money left in the drawdown pot will not be liable for Inheritance Tax. | If too much is taken out of your drawdown pot, then you could face hefty tax bills. |

Retirement planning services

It’s important that professional advice is taken before deciding upon a retirement strategy. The right strategy should be tailored to the individual’s needs and circumstances.