Top Financial Tips

https://www.ellisbates.com/wp-content/uploads/2022/10/10-tips-finances.png 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=g

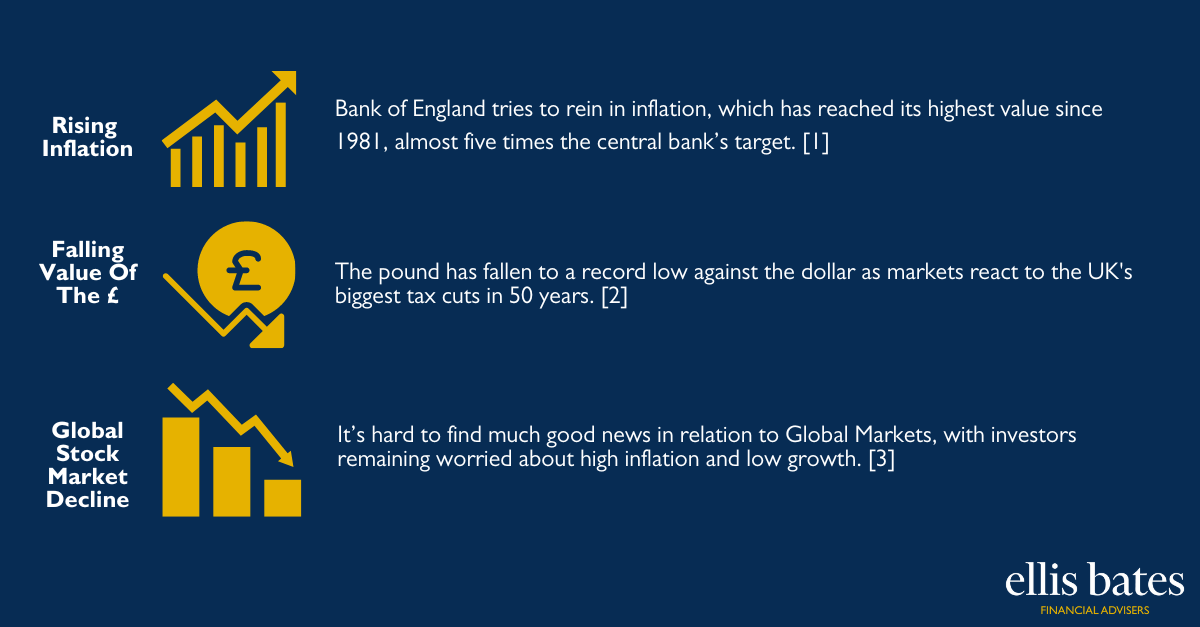

In these uncertain times, it’s more important than ever to make sure your finances are in order. We have 10 practical steps to ensure your money is working hard for you.