Is it time to give your pensions a health check?

https://www.ellisbates.com/wp-content/uploads/2024/10/Financial-Fitness.png 793 748 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=gEntering your 50s is not just another chapter in your life; it’s a profound and exciting phase in your financial journey. By this time, life may have settled into a more predictable rhythm. Perhaps your children are financially independent, and your career is at a peak, providing a stable income.

Pension review

In your 50s, a pension review is pivotal in preparing for a secure retirement. This review thoroughly evaluates your current pension plans to understand their performance and projected future income.

In your 50s, a pension review is pivotal in preparing for a secure retirement. This review thoroughly evaluates your current pension plans to understand their performance and projected future income.

Conducting this review ensures that you know how on track you are to achieving a comfortable retirement, providing you with confidence and clarity as you approach this life stage.

Obtain a State Pension forecast: If you haven’t already done so you can obtain a State Pension forecast from the Gov.uk website.

Review pension statements: Gather and review your latest pension statements to understand your current savings and projected retirement income.

Evaluate progress: Check if you are on track to meet your retirement goals. Consider factors like your desired retirement age and lifestyle.

Consolidate your pension pots: If you have had more than one employer in your lifetime, you’ll probably have more than one pension pot, too. If appropriate, consider transferring your old pensions and combining them under one roof, giving you more control of your money and where you’re invested in the run-up to and in retirement.

Envision your future: Start imagining what retirement might look like for you. Consider travel, hobbies, part-time work or any other aspirations.

Have a retirement plan: A general idea of your retirement goals can help shape your financial planning and savings strategy.

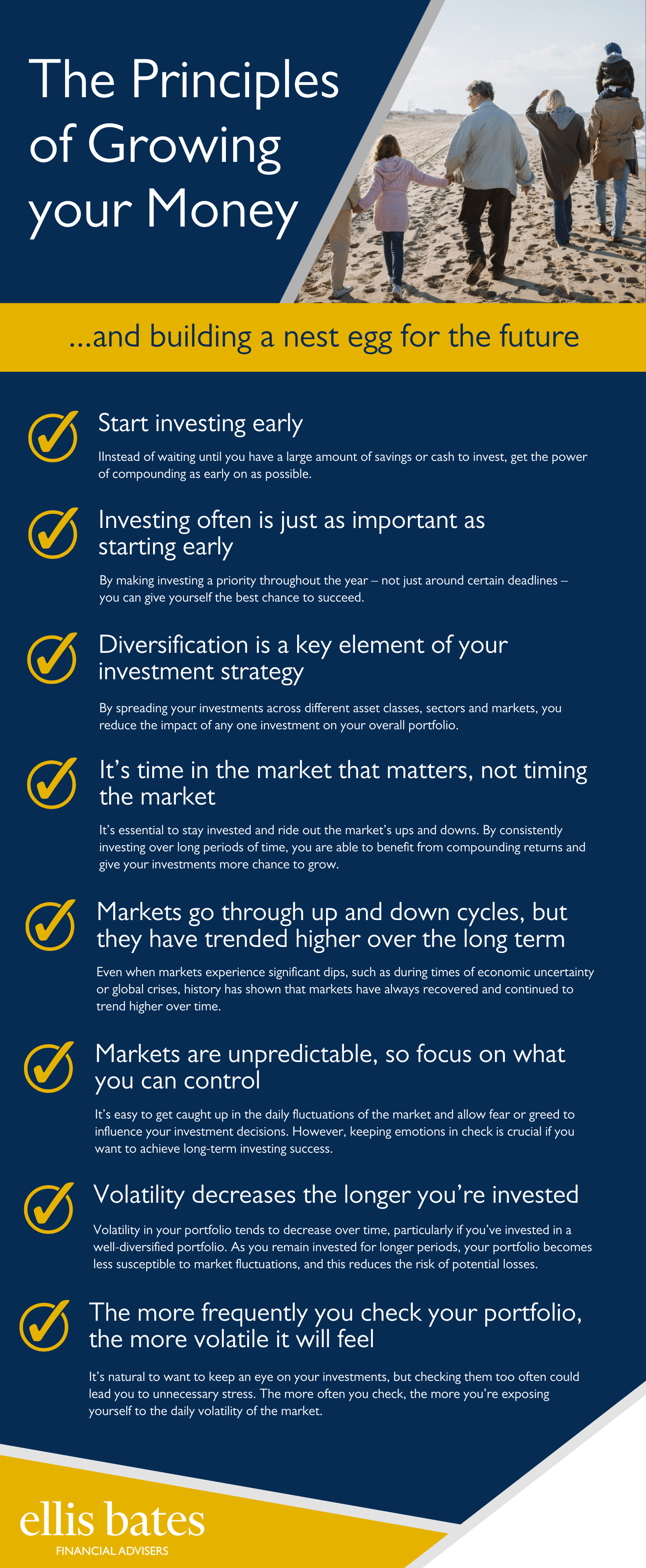

Amplified retirement savings: If appropriate, you can boost your pension contributions to increase the overall amount saved, creating a larger pool of funds to support your retirement lifestyle. Even small increases can lead to substantial growth, ensuring you have more resources to draw upon in your golden years.

Power of compounding: One of the most important aspects of saving for retirement is the effects of compounding, which allows your money to grow exponentially. The earlier and

more you contribute, the more time your savings have to benefit from compounding. This means your contributions not only earn interest, but that interest also earns interest, leading to significant growth over the years.

Tax relief advantages: Pension contributions are highly tax-efficient. Depending on your tax bracket, you receive tax relief on the money you contribute, effectively reducing the net cost of your contributions. For example, if you’re a basic rate taxpayer, a £1,000 contribution might only cost you £800 after tax relief. This government top-up adds an extra layer of growth to your pension fund, enhancing its value.

Increase financial security: By ensuring you have sufficient savings for retirement, you reduce the risk of financial insecurity later in life. This financial cushion can help maintain your standard of living and provide peace of mind that you won’t outlive your savings.

Flexibility and options in retirement: A larger pension pot provides more choices when it comes to retirement planning. Whether you want to travel, pursue hobbies or ensure you can cover healthcare costs, having additional funds gives you the freedom to make these decisions without financial constraints.

Protection against inflation: Increasing contributions helps counteract the eroding effect of inflation on your savings. As the cost of living rises, having a robust pension fund means you’re better positioned to keep up with expenses, maintaining your purchasing power well into retirement.

Discuss retirement plans: Share your retirement goals and plans with your family to ensure everyone is on the same page.

Involve your partner: If applicable, coordinate financial planning efforts with your partner to optimise joint retirement outcomes.

Track investment performance: Regularly check how your pension investments perform against projections.

Adjust investment strategy: Be open to adjusting your investment strategy if your pension isn’t growing as expected.

Understand your Pension Annual Allowance: Check your Pension Annual Allowance, typically £60,000 or 100% of your UK relevant earnings, whichever is lower. If you have no relevant earnings, up to £3,600 could qualify for tax relief. Note any reductions if you have a high income or have triggered the Money Purchase Annual Allowance (MPAA).

Explore carry-forward options: Investigate the possibility of carrying forward unused allowances from the previous three tax years. !is can be complex, so ensure you meet the eligibility criteria.

Optimise Individual Savings Account (ISA) contributions: Consider contributing up to the £20,000 limit in the 2024/25 tax year. ISAs offer tax-efficient growth and withdrawals, making

them an effective savings tool.

Choose the suitable ISA: Examine your balance between cash and investments. Decide between Cash ISAs or Stocks & Shares ISAs based on your risk tolerance, capacity for loss and financial goals.

Capital Gains Tax exemption: Be aware of the annual Capital Gains Tax exemption, which allows you to realise gains up to a certain amount without paying tax (£3,000 in 2024/25). Plan

asset sales accordingly.

Dividend and Personal Savings Allowance: Utilise the Dividend and Personal Savings Allowance to minimise taxes on investment income and savings income.

Review annually: Make it a habit to review your tax strategy annually, ensuring it aligns with your goals and takes full advantage of available allowances.

Discuss financial strategies: Share your tax planning strategies with your family to ensure they understand and can support your financial decisions.

If you would like to give your pensions a health check, get in touch today: