After Retirement – helping your loved ones

https://www.ellisbates.com/wp-content/uploads/2024/07/Screenshot-2024-07-17-145722-1024x579.png 1024 579 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=gYour financial adviser will have helped you plan a secure retirement lifestyle and naturally your thoughts will now be turning to how you can help your family now and in the future. Your adviser will guide you through key stages including

- Estate planning

- Legislation changes and their impact

- Tax implications

- Gifting

- The role of Wills, Trusts and Lasting Powers of Attorneys

Your adviser’s role is to ensure you enjoy your retirement and bring expertise into successfully passing on your wealth in the right stages.

If you would like to discuss your and your family’s financial future, please get in touch.

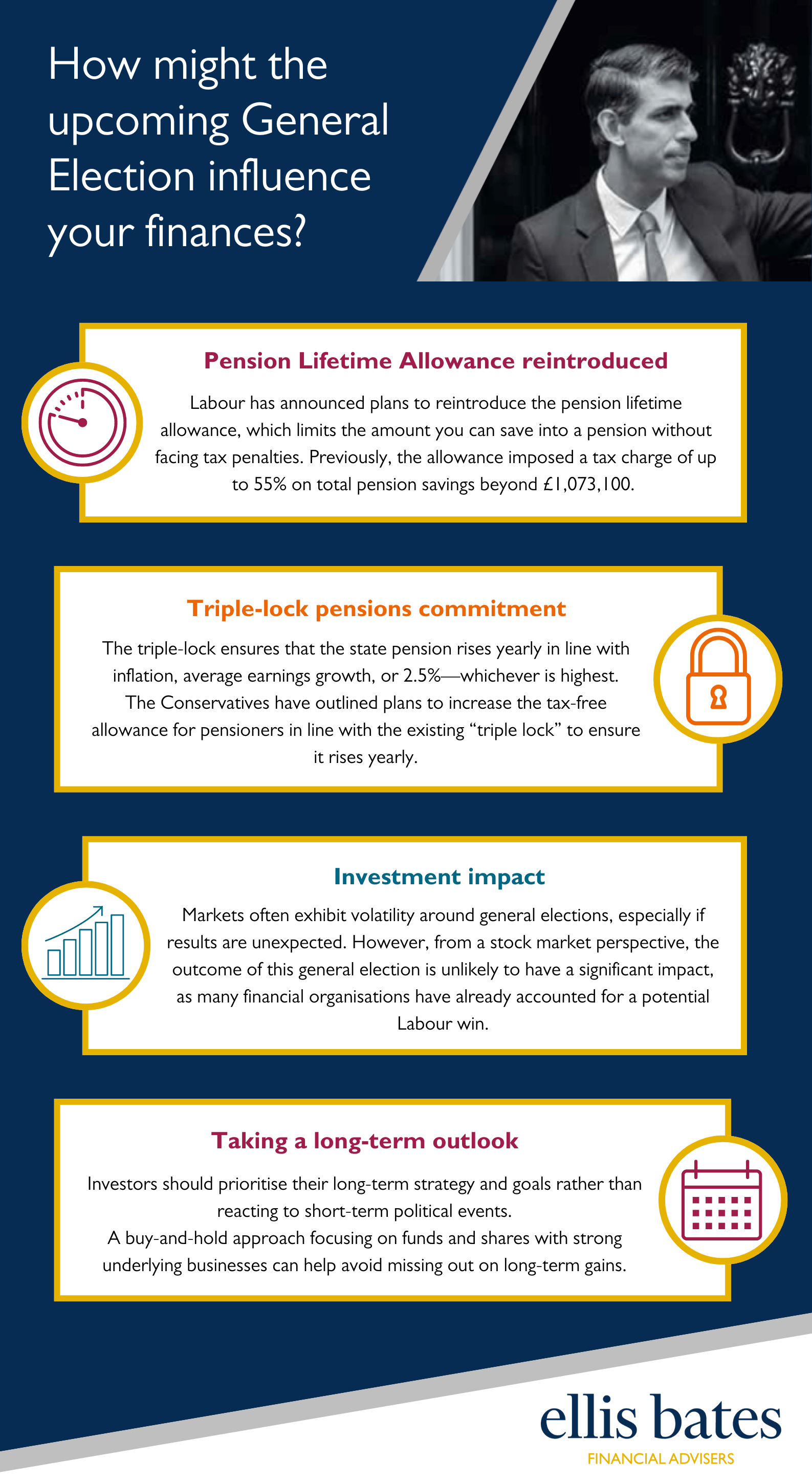

Pension Lifetime Allowance reintroduced

Pension Lifetime Allowance reintroduced