How the upcoming General Election might influence your finances?

https://www.ellisbates.com/wp-content/uploads/2024/06/Picture1.2.png 792 498 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=g

Investment impact

Markets often exhibit volatility around general elections, especially if results are unexpected. However, from a stock market perspective, the outcome of this general election is unlikely to have a significant impact, as many financial organisations have already accounted for a potential Labour win.

While the stock market may fluctuate briefly before and after the election, history suggests that markets typically stabilise in the following months. For instance, after the 2010 general election, which resulted in a hung parliament, the FTSE All-Share index fell by 3% but quickly recovered once a coalition government was announced. Six months later, the index was up nearly 10%.

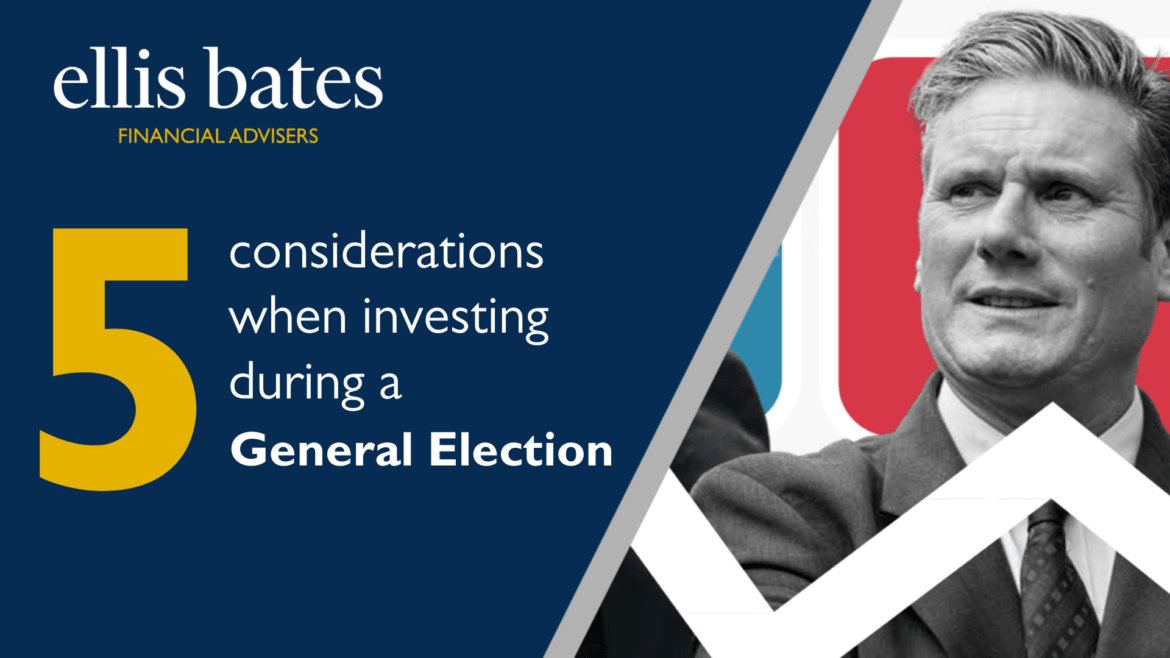

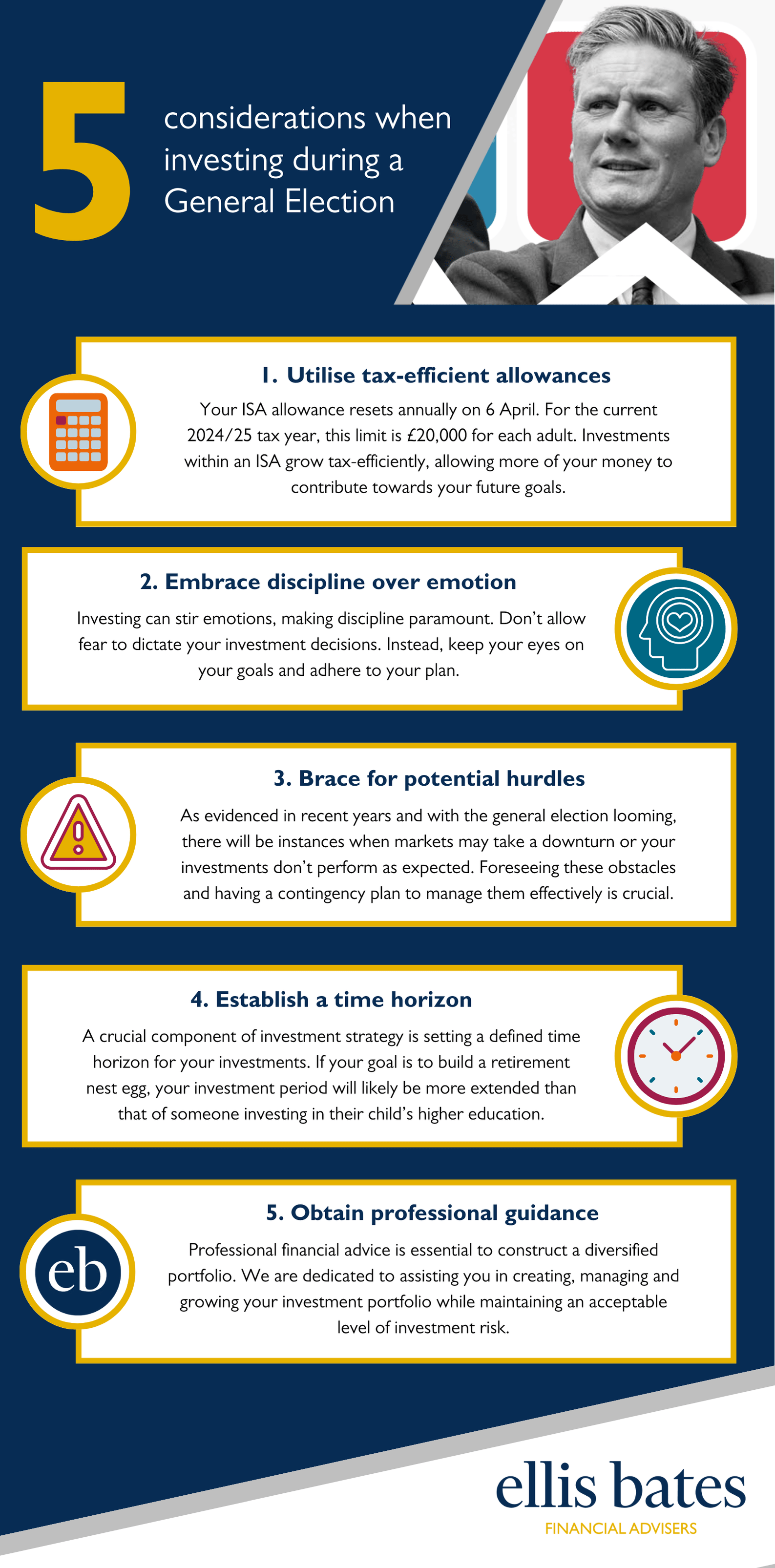

Individual Savings Accounts (ISAs) could become increasingly important for investors if further tax rises occur.

Labour has previously advocated for simplifying ISAs, while the Conservative government is currently consulting on the “British ISA.” A change in government might lead to the end of this initiative.

The annuity market has been strong recently, driven by high interest rates. However, with a general election now on the horizon, the likelihood of a rate cut this summer diminishes, suggesting that annuity rates may remain elevated for longer.

Taking a long-term outlook

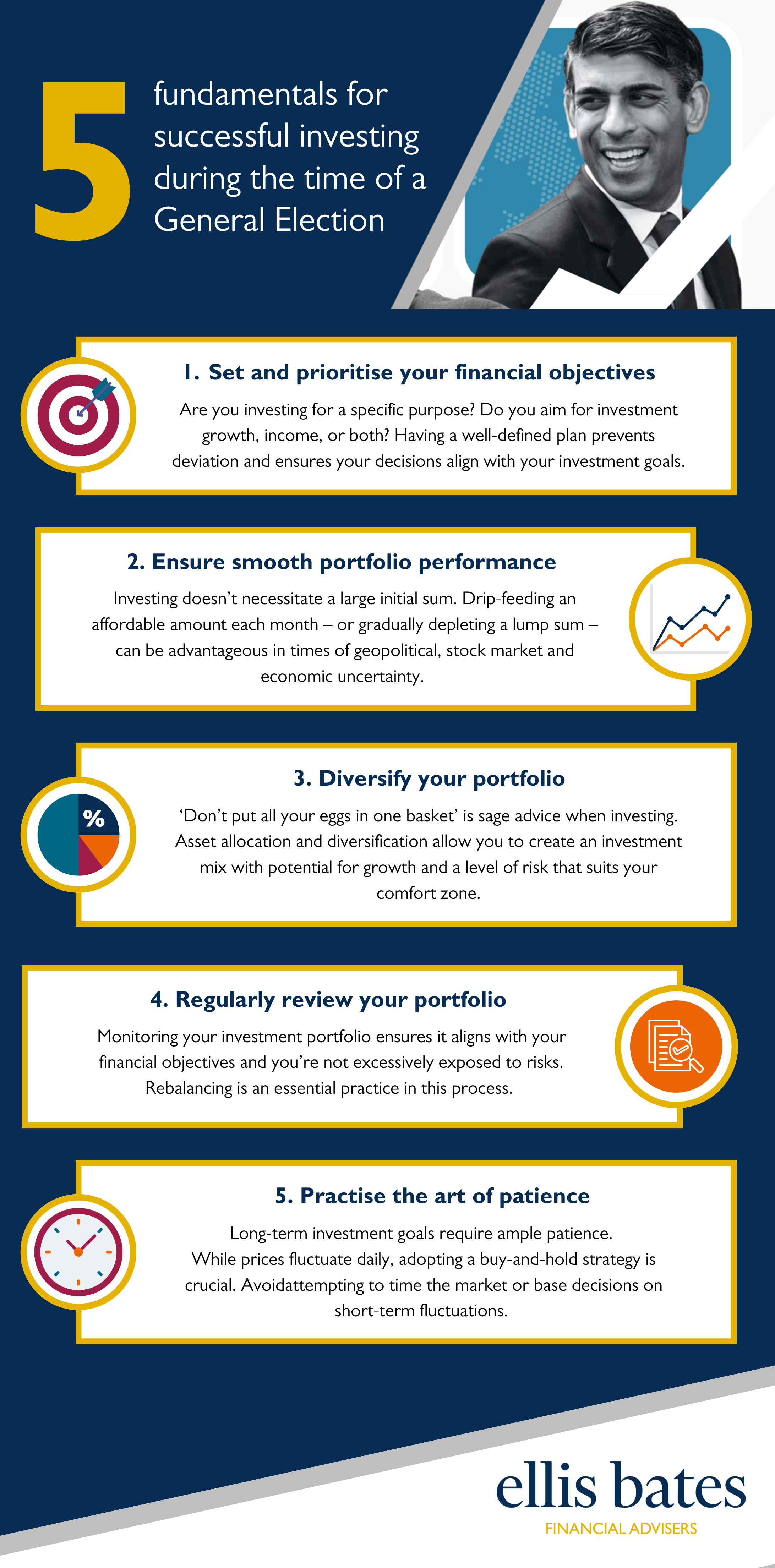

Investors should prioritise their long-term strategy and goals rather than reacting to short-term political events. A buy-and-hold approach focusing on funds and shares with strong underlying businesses can help avoid missing out on long-term gains.

Diversification across various asset classes and currencies is crucial. By spreading investments across different assets with varying levels of risk, investors can mitigate the impact of a downturn in any particular market or sector.

Additionally, maintaining a cash reserve during times of uncertainty can provide the flexibility needed to respond to new information as it becomes available. Volatility often presents opportunities, so investors need to avoid making knee-jerk decisions.

If you’d like to discuss your financial future and how the election may impact your finances, get in touch:

Pension Lifetime Allowance reintroduced

Pension Lifetime Allowance reintroduced