When should I contact a Financial Advisor?

https://www.ellisbates.com/wp-content/uploads/2023/10/When-should-I-contact-a-Financial-Advisor-holder.jpg 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=g

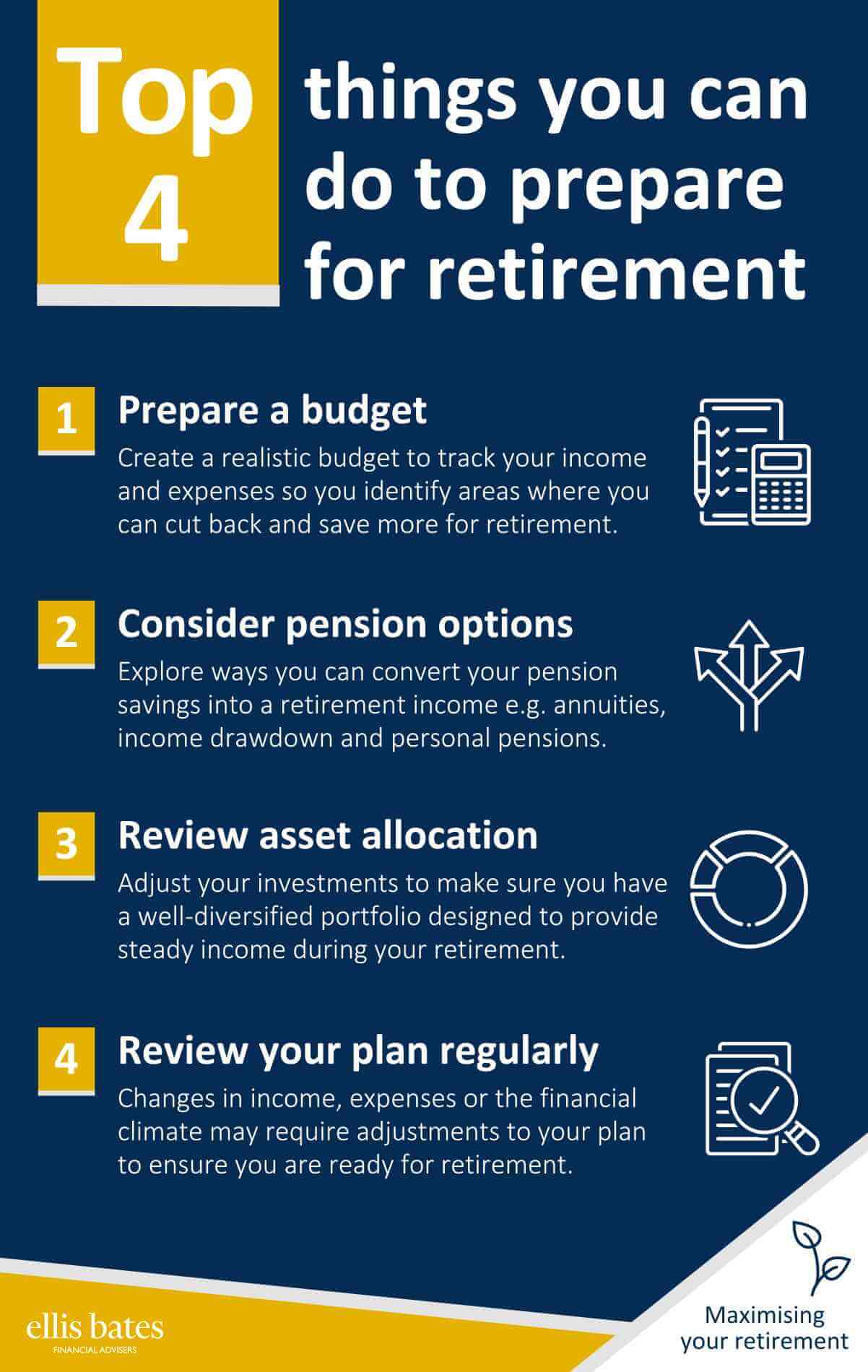

At Ellis Bates we use sophisticated cash flow modelling software which will help you to visualise your financial future and life goals and the financial actions you need to take – from starting your first job right through to enjoying your chosen retirement.

We are delighted to announce that Ellis Bates are once again in the FT Advisers Top 100 Financial Advisers 2023.

We are delighted to announce that Ellis Bates are once again in the FT Advisers Top 100 Financial Advisers 2023.