Exploring strategies to secure your family’s financial future

https://www.ellisbates.com/wp-content/uploads/2024/11/Ebookbrochure-socials-3-1024x535.png 1024 535 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=gThe amount of Inheritance Tax (IHT) paid by families has dramatically increased over the past decade, increasing from £3.1 billion in the 2012/13 tax year to £7.5 billion in the 2023/24 tax year.

This rise is attributed to growing asset values and stagnant IHT thresholds, coupled with many families delaying their planning.

Download our latest guide to look at how to maximise IHT allowances, strategic planning to reduce IHT, tax-efficient gifting and transfers, utilising pensions for IHT efficiency and additional strategies for reducing IHT.

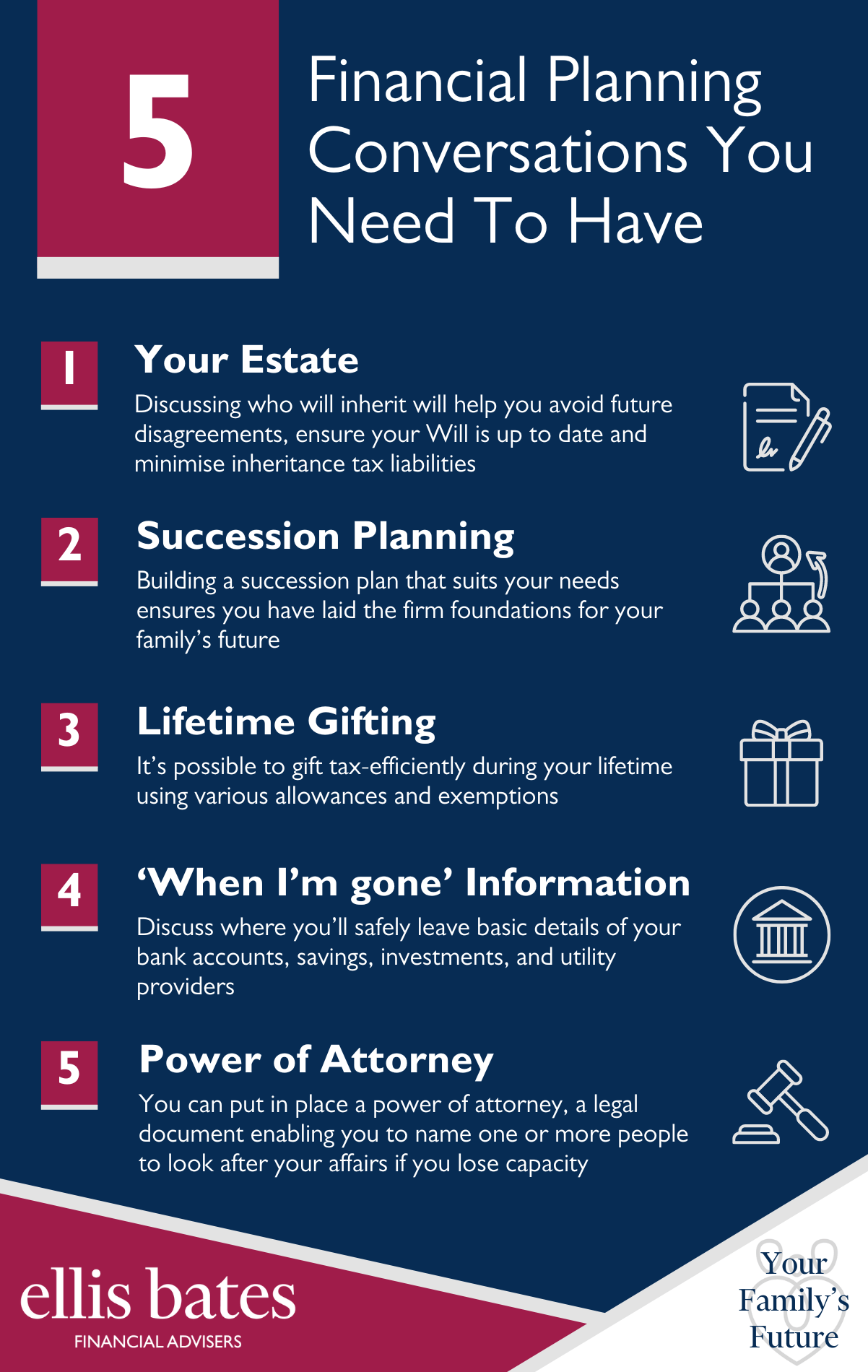

Many people still lack a properly organised estate plan despite the numerous benefits of writing a Will—such as getting our finances in order, planning our legacy, and ensuring that our loved ones are well looked after.

Many people still lack a properly organised estate plan despite the numerous benefits of writing a Will—such as getting our finances in order, planning our legacy, and ensuring that our loved ones are well looked after.

Protecting your legacy and boosting your children’s financial security

Protecting your legacy and boosting your children’s financial security

Start your estate and inheritance planning as early as possible and implement in stages

Start your estate and inheritance planning as early as possible and implement in stages