Understanding the rising impact of Inheritance Tax

https://www.ellisbates.com/wp-content/uploads/2024/11/Picture2.jpg 794 614 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=gExploring strategies to secure your family’s financial future

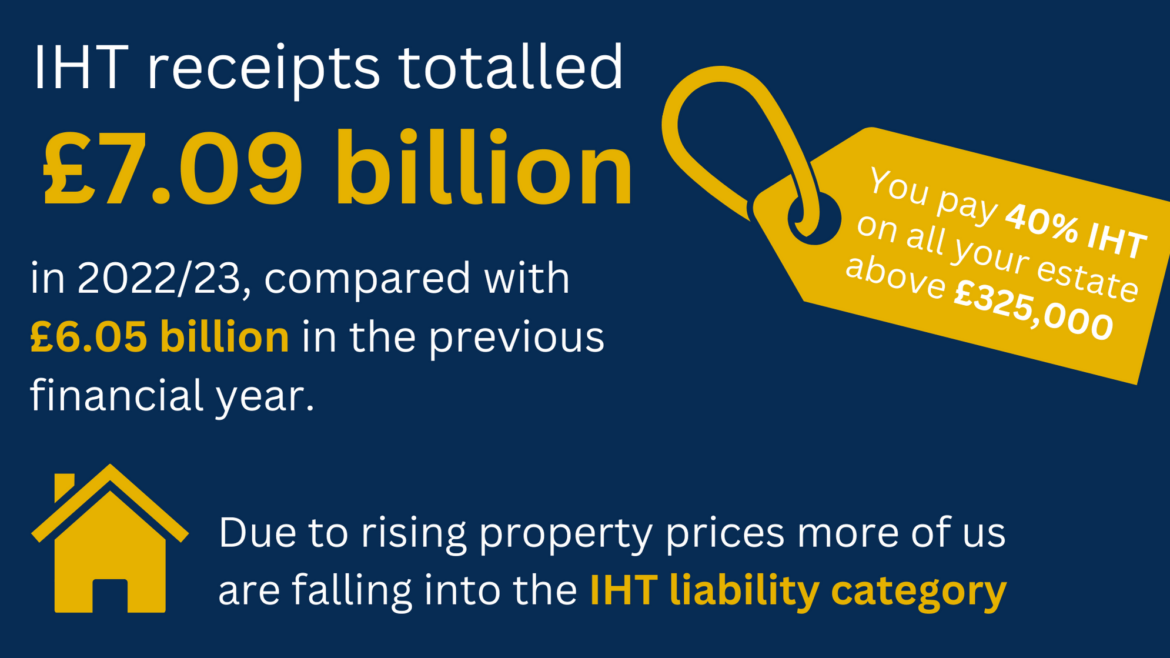

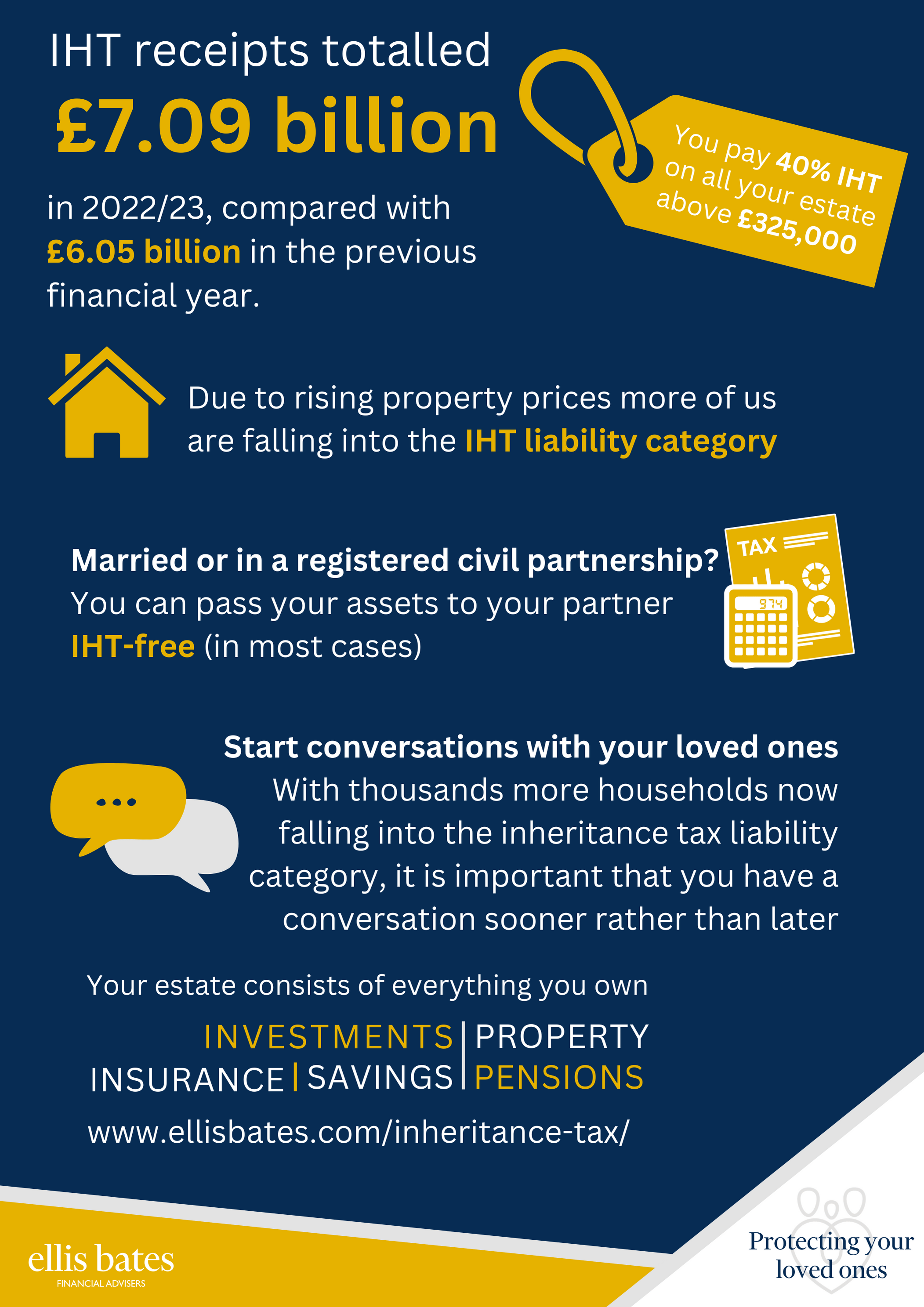

The amount of Inheritance Tax (IHT) paid by families has dramatically increased over the past decade, increasing from £3.1 billion in the 2012/13 tax year[1] to £7.5 billion in the 2023/24 tax year[2].

The amount of Inheritance Tax (IHT) paid by families has dramatically increased over the past decade, increasing from £3.1 billion in the 2012/13 tax year[1] to £7.5 billion in the 2023/24 tax year[2].

This rise is attributed to growing asset values and stagnant IHT thresholds, coupled with many families delaying their planning. An additional IHT allowance was introduced in 2017, allowing some families to pass on more assets without incurring IHT, yet the criteria for qualification can be complex.

WHAT IS INHERITANCE TAX (IHT)?

IHT is a tax levied on the transfer of wealth, typically paid by the estate of a deceased individual, but it can also apply during a person’s lifetime. Your estate includes all property, possessions, money and other assets.

If the value of your estate exceeds the nil rate band at the time of death, the excess is subject to IHT, generally at 40%. IHT is usually not applicable if everything is left to a spouse or registered civil partner. For the 2024/25 tax year, the IHT nil rate band is set at £325,000.

MAXIMISING IHT ALLOWANCES

Married couples and registered civil partners have the option to transfer any unused portion of their IHT nil rate band to the surviving partner, effectively doubling the threshold to £650,000. In addition, the ‘residence nil rate band’ introduced in 2017 can increase an individual’s IHT allowance if their main residence is passed on to direct descendants. This can potentially raise the overall IHT allowance to £500,000 per individual or £1 million per couple.

STRATEGIC PLANNING TO REDUCE IHT

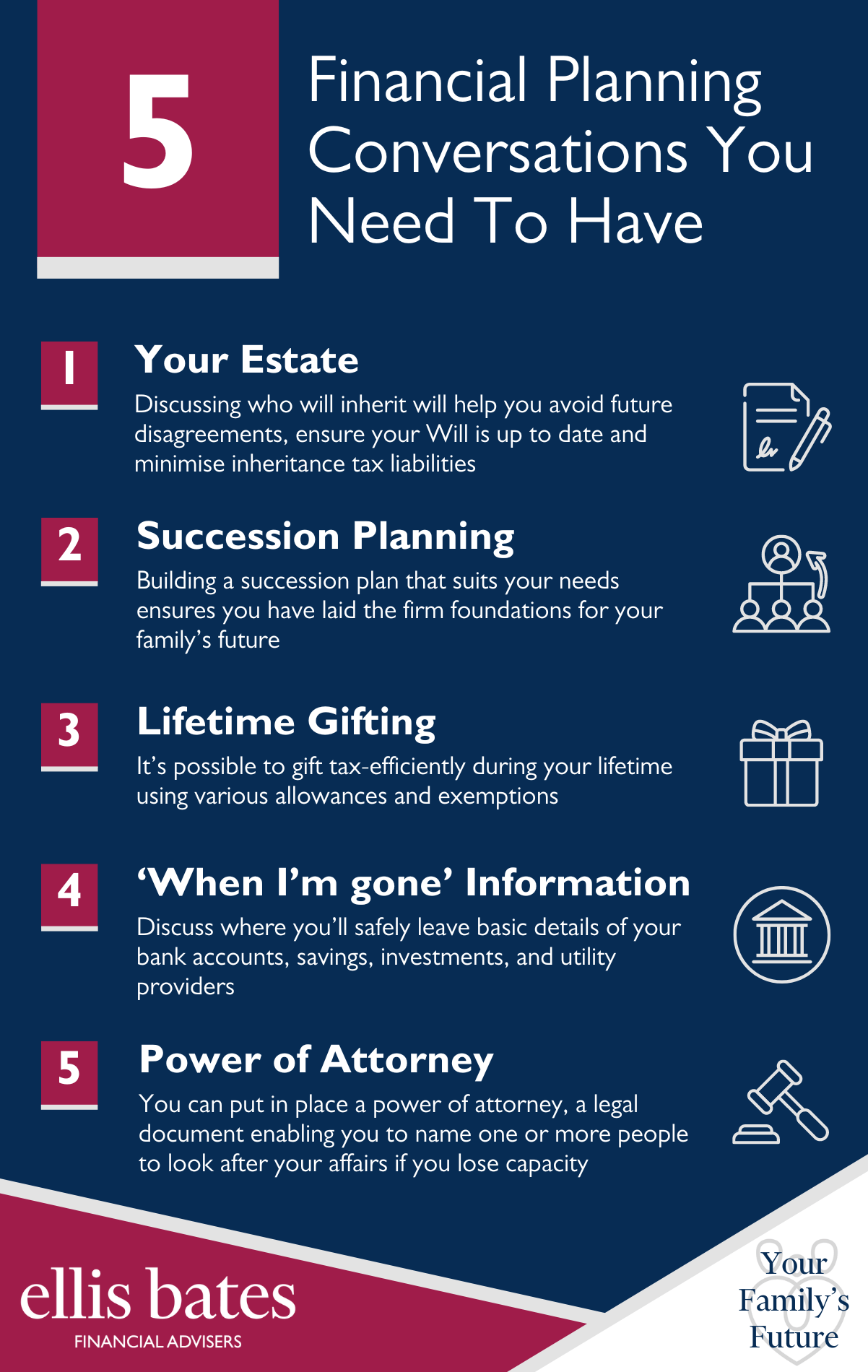

The residence nil rate band gradually diminishes by £1 for every £2 that the estate exceeds £2million, becoming unavailable for estates valued over £2.35 million. An up-to-date Will is crucial to effectively manage IHT liabilities, as older Wills may contain trusts that impact the nil rate bands. Some individuals may postpone wealth transfer until death, but gifting during their lifetime can be more tax-efficient.

TAX-EFFICIENT GIFTING AND TRANSFERS

Tax-efficient gifts (tax year 2024/25) currently include annual exemptions of £3,000, wedding or registered civil partnership gifts up to £5,000 for a child, £2,500 for a grandchild or £1,000 for others, and gifts from regular surplus income.

Small gifts of up to £250 per person annually are also exempt, provided no other gifts are made to that individual, which takes the total above £250. Gifts not covered by exemptions are either ‘potentially exempt transfers’ or ‘chargeable lifetime transfers,’ which require surviving seven years to be out of the estate and which may incur immediate IHT.

UTILISING PENSIONS FOR IHT EFFICIENCY

Pensions can also facilitate tax-efficient wealth transfer. Should you pass away before age 75, benefits left in a money purchase pension can generally be transferred tax-free. If death occurs post-75, these benefits are taxed at the beneficiary’s marginal Income Tax rate. It may be prudent to draw retirement income from other sources, preserving pension funds for inheritance purposes.

ADDITIONAL STRATEGIES FOR REDUCING IHT

Other IHT reduction methods include establishing trusts, exploring specialist investment vehicles and considering whole-of- life insurance policies written into an appropriate trust. However, the intricacies of these options highlight the importance of seeking professional financial advice early on. Early planning significantly enhances the ability to leave a legacy that meets your family’s specific needs.

READY TO TURN YOUR LEGACY PLANS INTO REALITY?

Don’t just leave a gift; leave a legacy. If you’re ready to explore strategies for reducing IHT liabilities and securing your family’s financial future, contact us for personalised advice tailored to your unique situation.

Let us help you turn your legacy plans into reality.

Source data:

[1] https://www.gov.uk/government/statistics/inheritance-taxstatistics-

table-121-analysis-of-receipts

[2] https://www.gov.uk/government/statistics/hmrctax-

and-nics-receipts-for-the-uk/hmrc-tax-receipts-andnational-

insurance-contributions-for-the-uk-new-annualbulletin#

inheritance-tax

Plan for Inheritance Tax

Plan for Inheritance Tax

Start your estate and inheritance planning as early as possible and implement in stages

Start your estate and inheritance planning as early as possible and implement in stages