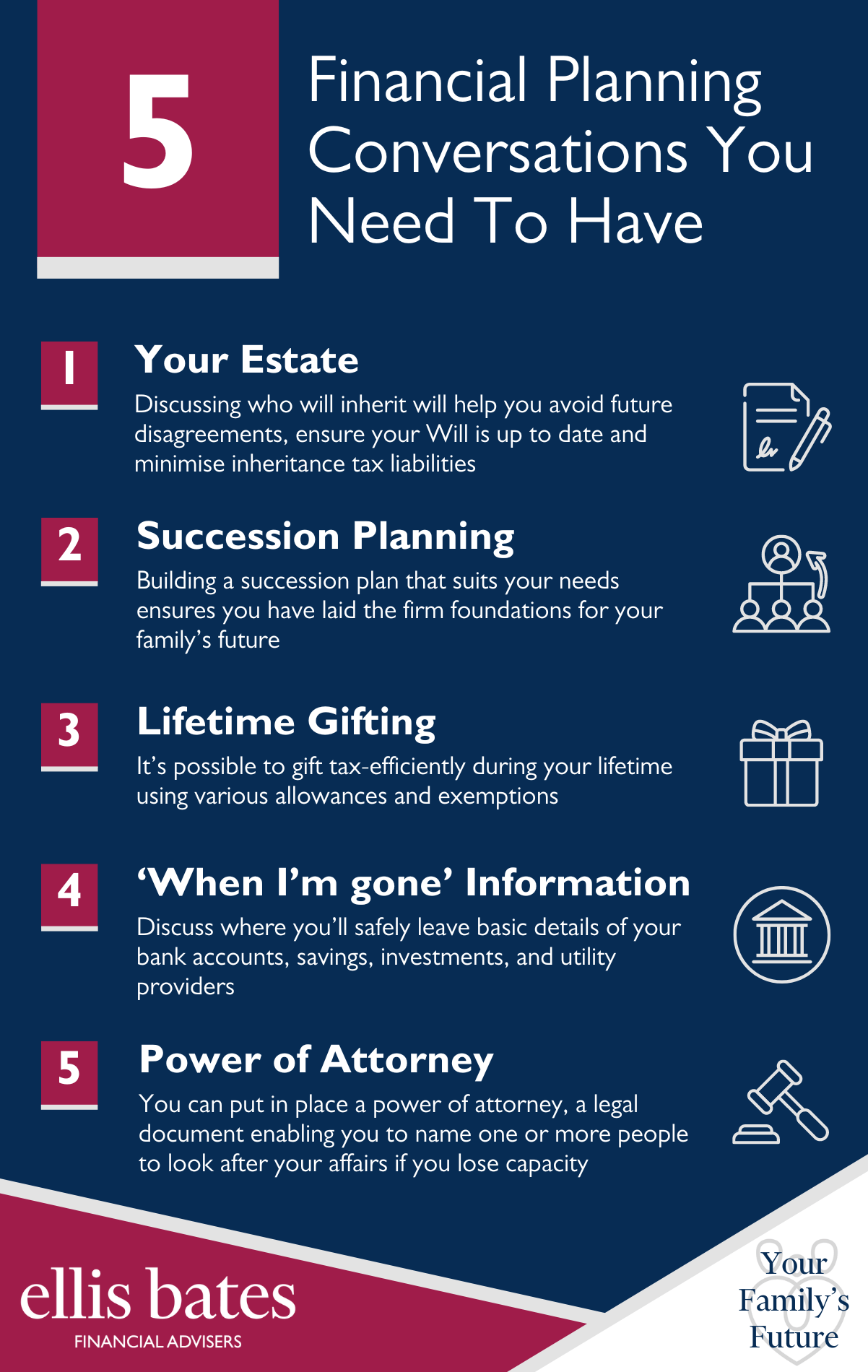

5 Financial Planning Conversations for you and your Family

https://www.ellisbates.com/wp-content/uploads/2024/07/Blog-social-posts-1024x535.png 1024 535 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=g

Discussing finances can evoke anxiety or discomfort, and this tension doesn’t ease when family members are involved..

How can you make financial planning conversations go smoothly?

- Your Estate

Discussing who will inherit will help you avoid future disagreements, ensure your Will is up to date and minimise inheritance tax liabilities

- Succession Planning

Building a succession plan that suits your needs ensures you have laid the firm foundations for your family’s future

- Lifetime Gifting

It’s possible to gift tax-efficiently during your lifetime using various allowances and exemptions

- When I’m gone Information

Discuss where you’ll safely leave basic details of your bank accounts, savings, investments, and utility providers

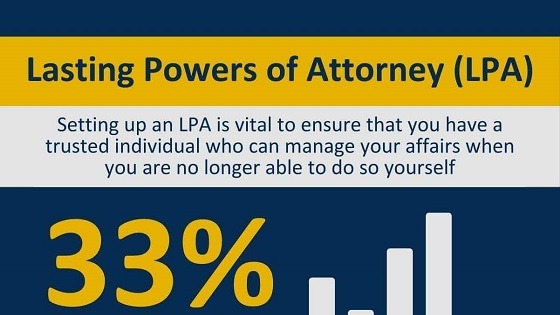

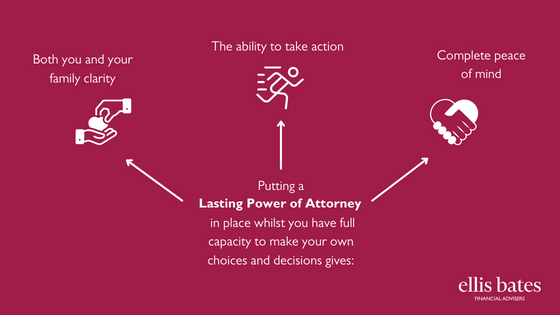

- Power of Attorney

You can put in place a power of attorney, a legal document enabling you to name one or more people to look after your affairs if you lose capacity

If you would like to discuss your family’s financial future and how we can help, please get in contact

Protecting your legacy and boosting your children’s financial security

Protecting your legacy and boosting your children’s financial security