Divorce and my Pension

https://www.ellisbates.com/wp-content/uploads/2023/01/Pensions-and-Divorce-560-×-315px.png 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=g

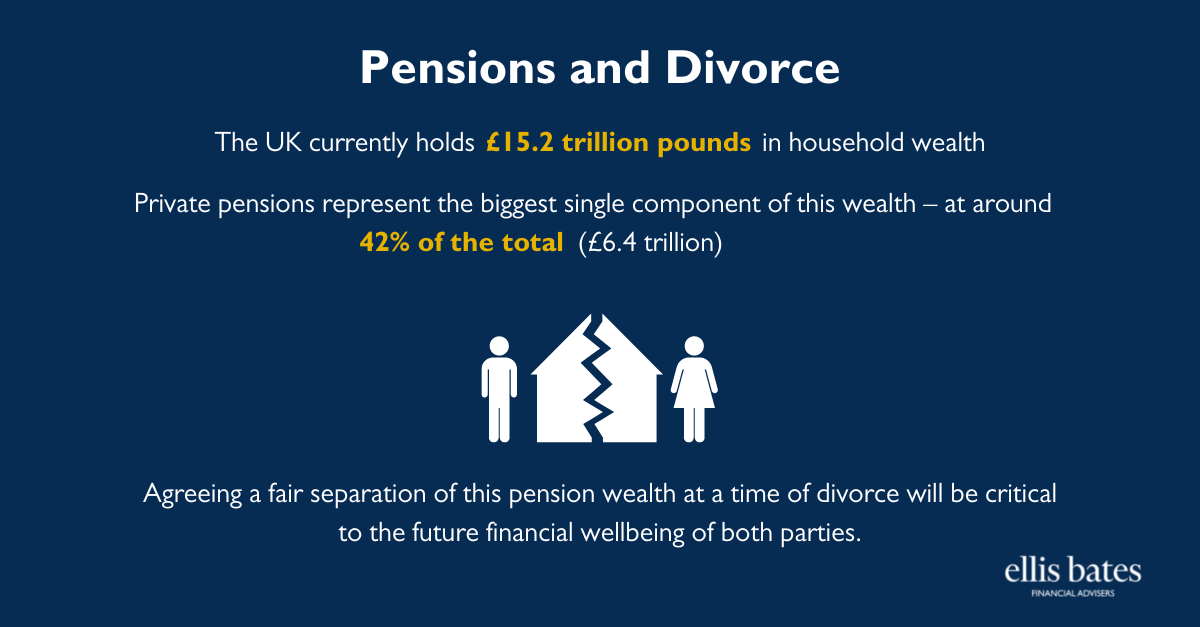

- The UK currently holds £15.2 trillion pounds in household wealth

- Private pensions represent the biggest single component of this wealth – at around 42% of the total (£6.4 trillion)

- Agreeing a fair separation of this pension wealth at a time of divorce will be critical to the future financial wellbeing of both parties

If you’re going through a divorce and would like to discuss your options regarding your pensions then please contact us.

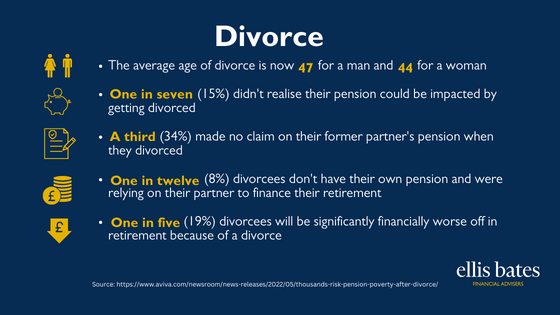

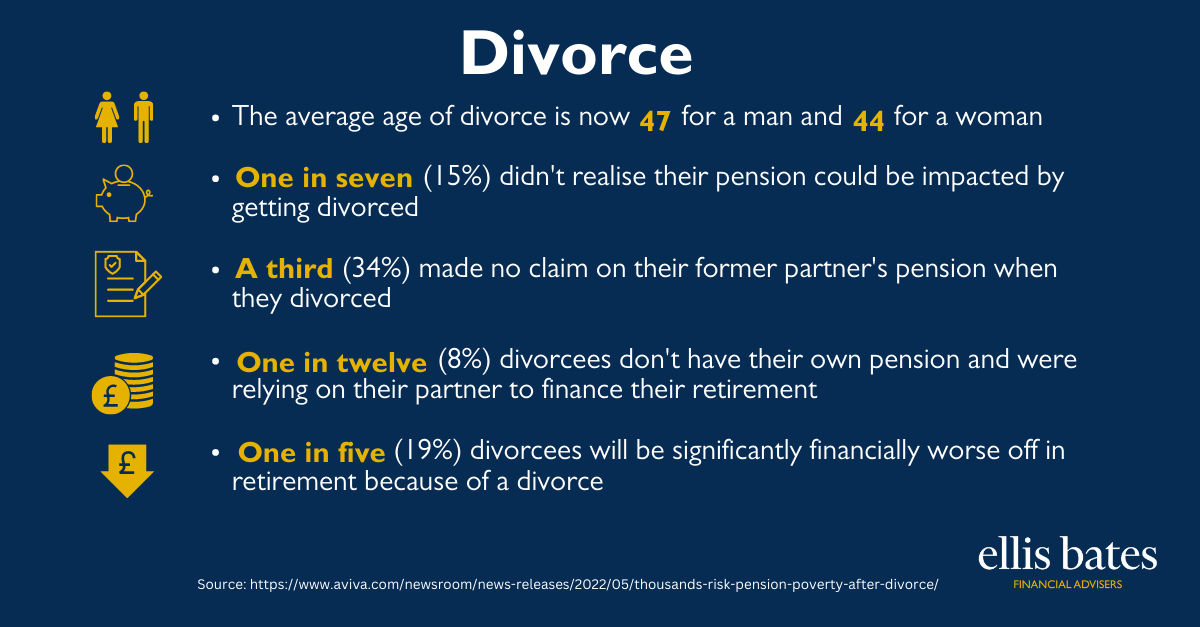

Women see incomes fall by 33% following divorce, compared to just 18% for men. Divorce is an emotionally charged event – and can be an expensive one. The financial impact of divorce can also last for decades and carry on into older age. Women are also often impacted harder financially by divorce, new research highlights.

Women see incomes fall by 33% following divorce, compared to just 18% for men. Divorce is an emotionally charged event – and can be an expensive one. The financial impact of divorce can also last for decades and carry on into older age. Women are also often impacted harder financially by divorce, new research highlights.