When am I financially ready to retire?

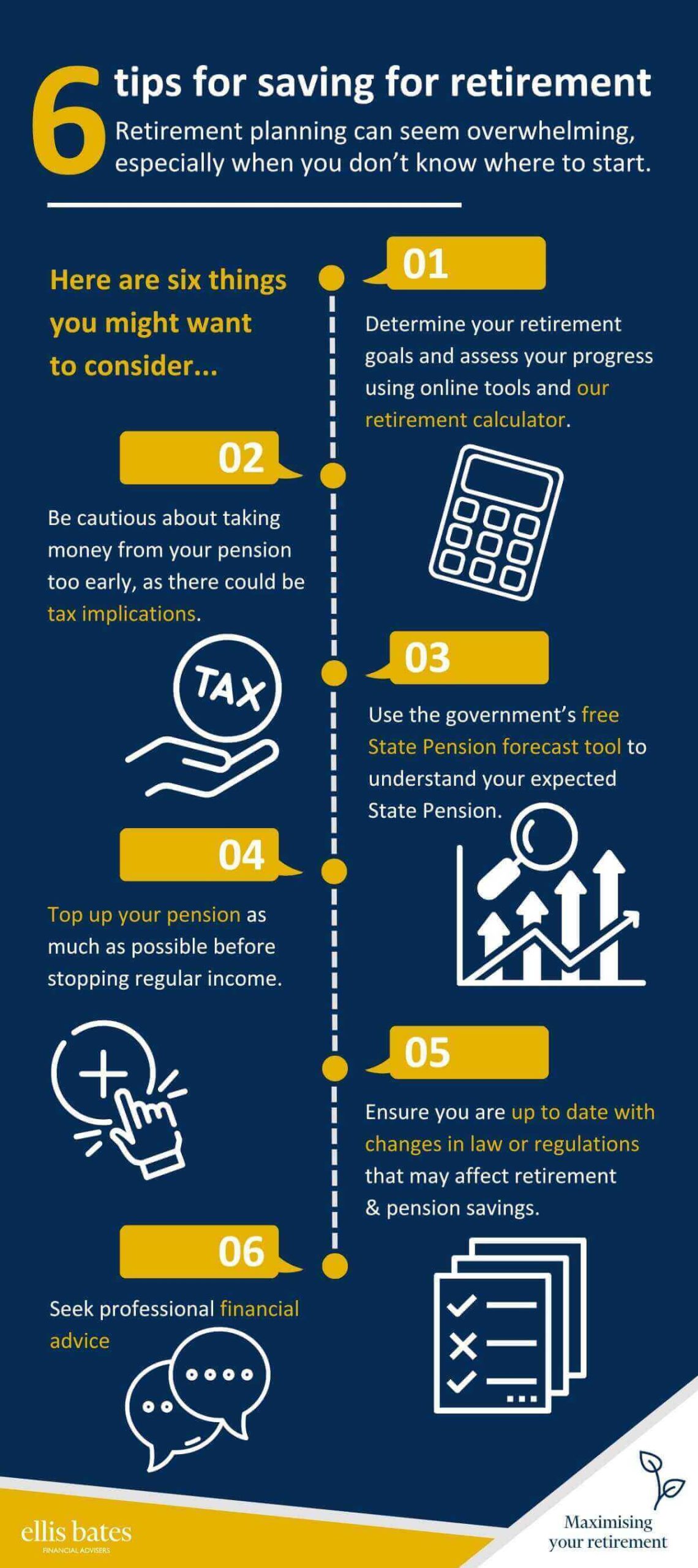

https://www.ellisbates.com/wp-content/uploads/2024/04/Screenshot-2024-04-25-100211-1024x577.png 1024 577 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=gThe earlier you start retirement planning, the better. However, with the demands of managing a busy working and personal life, this is something that can understandably be neglected. But it’s never too late to think about saving for retirement – even if you are planning to give up work in just a few years’ time, you will have options to add to your nest egg.

In our latest video, Financial Adviser Gary Davies discusses how to know if you are financially ready to retire.

If you are considering early retirement and would like to speak to a Financial Adviser, please get in touch:

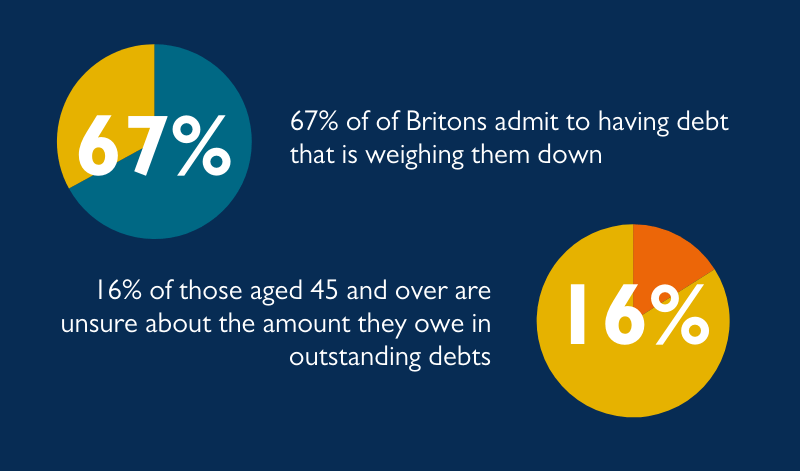

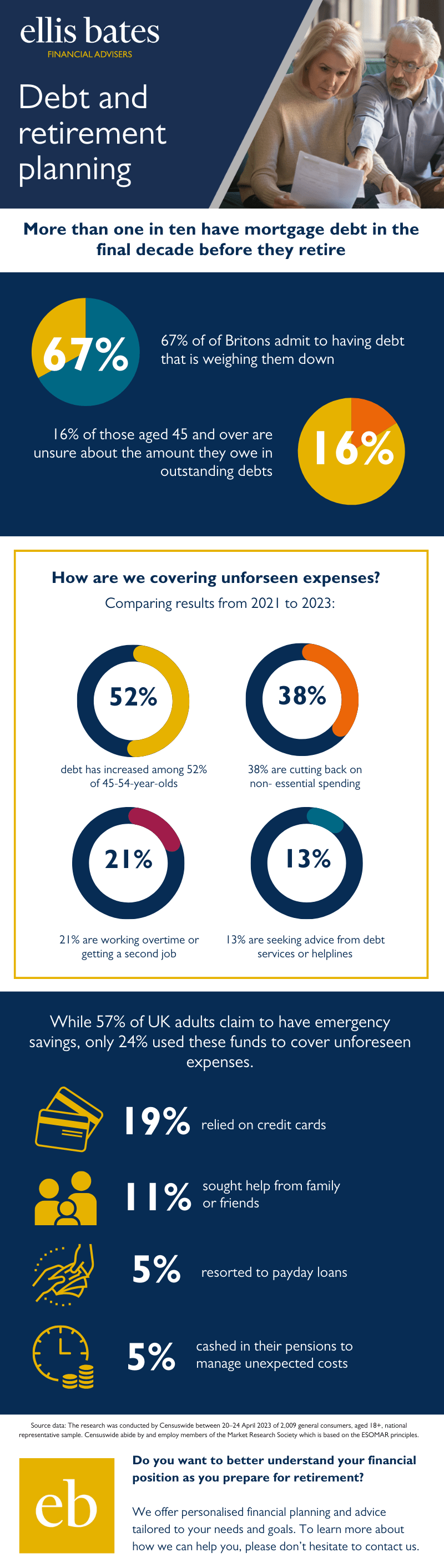

More than one in ten have mortgage debt in the final decade before they retire

More than one in ten have mortgage debt in the final decade before they retire