How much do you need to retire?

https://www.ellisbates.com/wp-content/uploads/2023/07/How-much-do-I-need-to-retire.jpg 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=g Retirement planning can seem overwhelming, especially when you don’t know where to start. But guidance from a professional Financial Advisor can provide peace of mind and help you create a holistic, comprehensive financial plan to achieve your retirement goals.

Retirement planning can seem overwhelming, especially when you don’t know where to start. But guidance from a professional Financial Advisor can provide peace of mind and help you create a holistic, comprehensive financial plan to achieve your retirement goals.

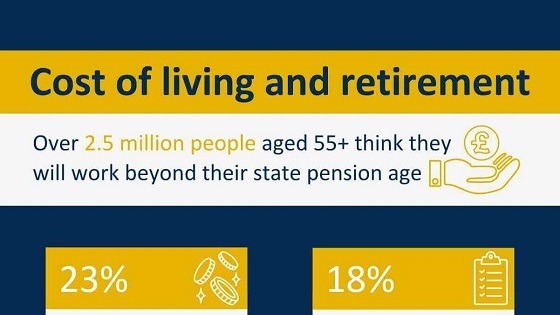

As you enter your 50s and 60s, retirement becomes a reality. It is essential to consider “when can I retire?” and “how much do I need to retire?”.

Remember that individuals aged 55 or over can start taking money from their pension. Starting from 6 April 2028, the average minimum pension age will increase to 57. This change may affect you differently depending on your birthdate.

It is worth considering whether taking money at this stage is necessary for your circumstances, as it may impact any tax implications. Ultimately, careful planning and consideration throughout life will help ensure that you have enough money saved when the right time comes to retire.

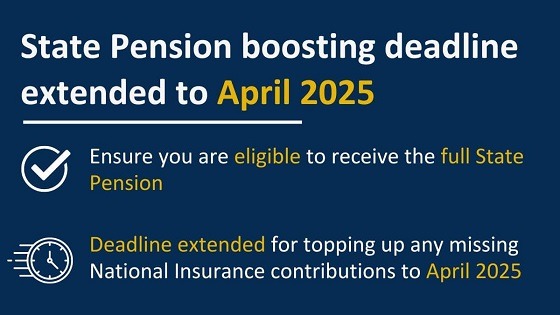

You should also ensure that you are up to date with any changes in the law or regulations that may affect your retirement and pension savings. As well as seeking professional financial advice, it is a good idea to keep an eye on government announcements and stay informed about news related to pensions and retirement. This can help ensure you receive the best returns for your investments when the time comes to retire.

- Determine your retirement goals and assess your progress using online tools and our retirement calculator.

- Be cautious about taking money from your pension too early, as there could be tax implications.

- Use the government’s free State Pension forecast tool to understand your expected State Pension.

- Top up your pension as much as possible before stopping regular income.

Expert Financial Advice

The journey towards and through retirement differs for us all. Our Financial Advisors will work closely with you to help you outline your retirement objectives and create a robust plan to get you there. To find out more or discuss how one of our Financial Advisors can help you, please get in touch.

Important information: This guide does not constitute tax or legal advice and should not be relied upon as such. Tax treatment depends on the individual circumstances of each client and may be subject to change in the future. For guidance, seek professional advice.

A pension is a long-term investment not normally accessible until age 55 (57 from April 2028 unless the plan has a protected pension age). the value of your investments (and any income from them) can go down as well as up, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

7 Benefits of Financial Advice

7 Benefits of Financial Advice