Are you ready to retire?

https://www.ellisbates.com/wp-content/uploads/2023/06/Are-you-ready-to-retire.jpg 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=g 6 Questions to ask yourself for a secure financial future

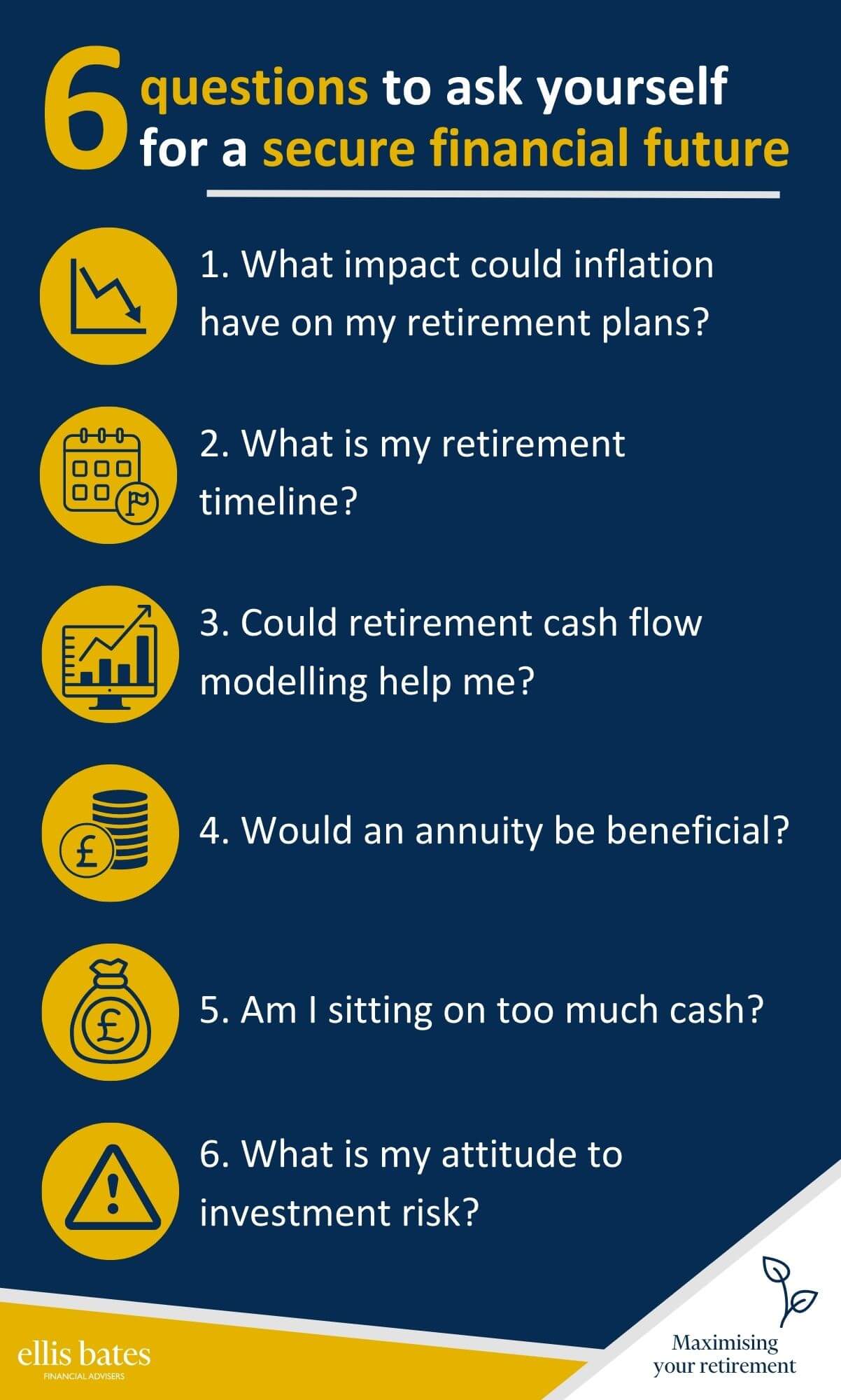

6 Questions to ask yourself for a secure financial future

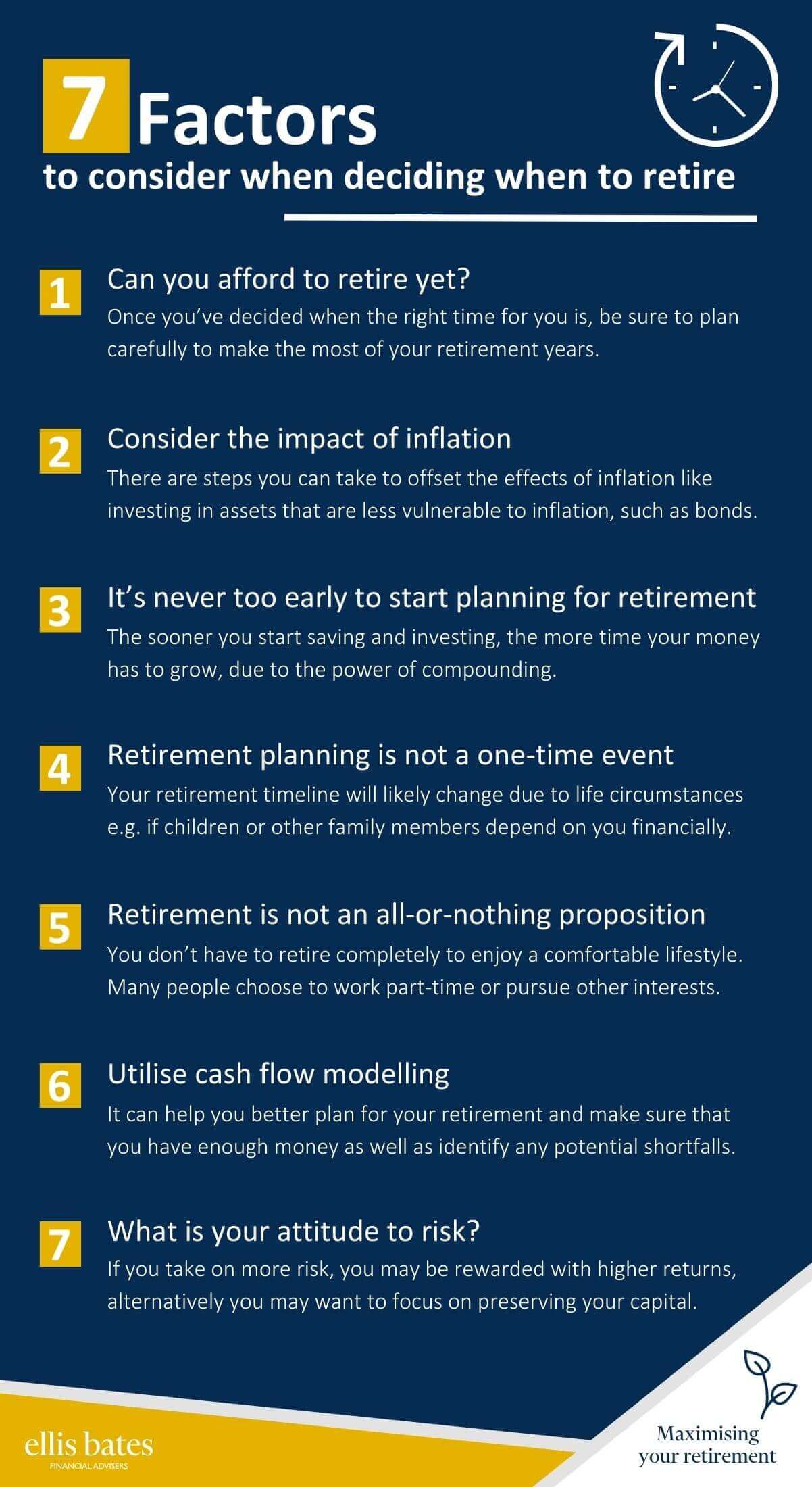

The concept of retiring is an attractive prospect for many people. Having the freedom to enjoy life and pursue hobbies or interests without the pressures of a 9-5 working life can be hugely appealing. However, it’s important to make sure that you have your finances planned out to make this dream of retirement achievable.

While there are variations in what defines true financial security for retirement, planning ahead is a key factor that should not be overlooked when considering when you should retire. This means starting to plan your finances well before you expect to retire so that you can build up enough funds over time.

Figure out when you are truly ready to retire

There are signs and targets that can signal that you are prepared to retire, but it can be difficult to figure out when you are truly ready to retire. We may think of retirement as being centred around a particular age or monetary amount. When we get to ‘X’ years old or have ‘Y’ amount of money, we can move on to our ‘golden years’.

The turbulent times we’re living through have given many people pause for thought to consider their work-life balance and think more seriously about what makes them happy. While happiness for many increases in retirement, others find their finances take the strain when they retire early, and money worries are one of the biggest factors resulting in people returning to work. If you aspire to retire early, it’s vital you plan your finances to be sustainable for the long term.

1. What impact could inflation have on my retirement plans?

Inflation is a major factor when planning for retirement because it can reduce the purchasing power of your money over time. If the amount you receive in retirement is based on a fixed income, it will not be able to keep up with future inflationary rises, meaning that you may likely be unable to afford the same lifestyle that you enjoyed before retirement.

Therefore, it is essential to plan for retirement by ensuring that your savings and investments can grow in real terms, above the rate of inflation. This can be done through a combination of investing in assets that aim to provide returns above the rate of inflation, as well as ensuring that your retirement income is not linked to a fixed amount but instead grows with inflation over time.

2. What is my retirement timeline?

When it comes to planning for your retirement, it’s best to get a plan in place far ahead of your intended retirement date. That way, you can take the time to gain a full understanding of your financial situation and identify any issues or opportunities for improvement. Ideally, you should start saving for retirement in your 20s and 30s, even if you don’t plan to retire for many years. This will help you build your savings over time and ensure that you have enough money to sustain yourself during retirement.

Of course, if you find yourself nearing retirement without a plan already in place, don’t fret, we are here to help. With our expertise and experience, we can work with you to optimise your retirement plans no matter how close you may be to retirement.

When considering your retirement timeline, there are several factors to consider: your age, income level and lifestyle, all of which will influence your retirement plans.

3. Could retirement cash flow modelling help me?

Retirement cash flow modelling is very useful in making assessments about your future retirement requirements. It enables you to consider all of your potential sources of income in retirement and how they can best be used to satisfy your expenditure needs.

This means considering a number of factors such as your underlying investments, tax and, most importantly, how well your different income streams are protected against inflation. Another benefit of using cash flow modelling is that you can easily change those assumptions if your circumstances change, factoring in different investment returns, tax rates and inflation. This allows you to assess how much you need to have accumulated prior to your retirement.

4. Would an annuity be beneficial?

Retirement is an important milestone in life, and it’s essential to make sure you have enough money to ensure a comfortable lifestyle afterwards. One of the options available to those retiring is an annuity. With fewer employers now offering the guarantee of a final salary pension, annuities could be an appropriate option to consider for some retirees. An annuity provides a regular income for the rest of your life and can make sure you have enough money to last you throughout retirement.

But to decide whether an annuity is right for you, it’s important to look at the different types of annuities available, consider the tax implications and other factors such as inflation. An annuity could be beneficial for those who have no capacity for their income to fall in the future, and those with reduced health.

5. Am I sitting on too much cash?

Even during periods of high inflation, investments that are in real assets can provide a hedge against the erosion of wealth. Cash holdings are ill-advised in this situation as the current interest rates barely meet inflation and its real value is guaranteed to decrease. Investing in assets is one of the best ways to safeguard your retirement savings against the effects of inflation.

Inflation can erode the value of your savings over time. By investing in real assets, you can help to ensure that your retirement savings remain secure even in a rising inflation environment. Investing in assets can provide you with the opportunity to create a sustainable and secure retirement plan that is protected from the effects of inflation. Ultimately, investing in real assets is an important part of any comprehensive retirement savings strategy.

6. What is my attitude to investment risk?

When making investment decisions, you need to establish the level of risk that you are comfortable with. This will vary from person to person, so it is important to obtain professional advice to help you assess your risk tolerance. Understanding your attitude to investment risk is an important factor when planning for retirement. Taking the time to learn about how you respond to different kinds of market volatility and levels of risk will help you create a more informative and effective retirement plan.

Knowing what kind of investor you are – conservative, balanced or aggressive – will enable you to make informed decisions about where to invest your money and how much risk you are comfortable taking on. It can also help you avoid some of the common pitfalls associated with retirement planning, such as being too conservative or overly aggressive in your approach. This will help you to save and invest more effectively, allowing you to make the most of your retirement savings.