Busting the myths about pensions

https://www.ellisbates.com/wp-content/uploads/2023/03/Myths-vs-facts.jpg 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=g

If you are approaching retirement age, it’s important to know your pension is going to finance your future plans and provide the lifestyle you want once you stop working. Pension legislation is extremely complex and it’s not realistic to expect everyone to understand it completely. But, since we all hope to retire one day, it is important to get to grips with some of the basics.

Many of us have made pension provision, but some of us don’t know very much about the details. To help you get a handle on some of the myths around pensions, we’ve got answers to some of the things you may have been wondering about. It’s particularly helpful to become aware of the things you may have thought were facts that are actually myths. Here are some examples.

Myth: The government pays your pension

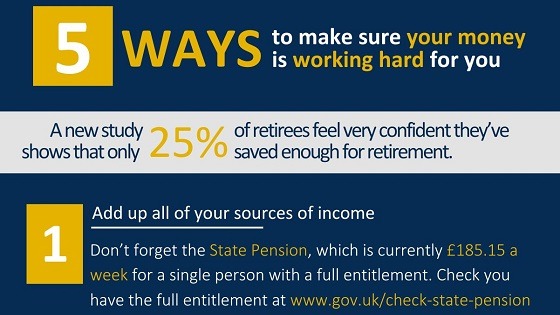

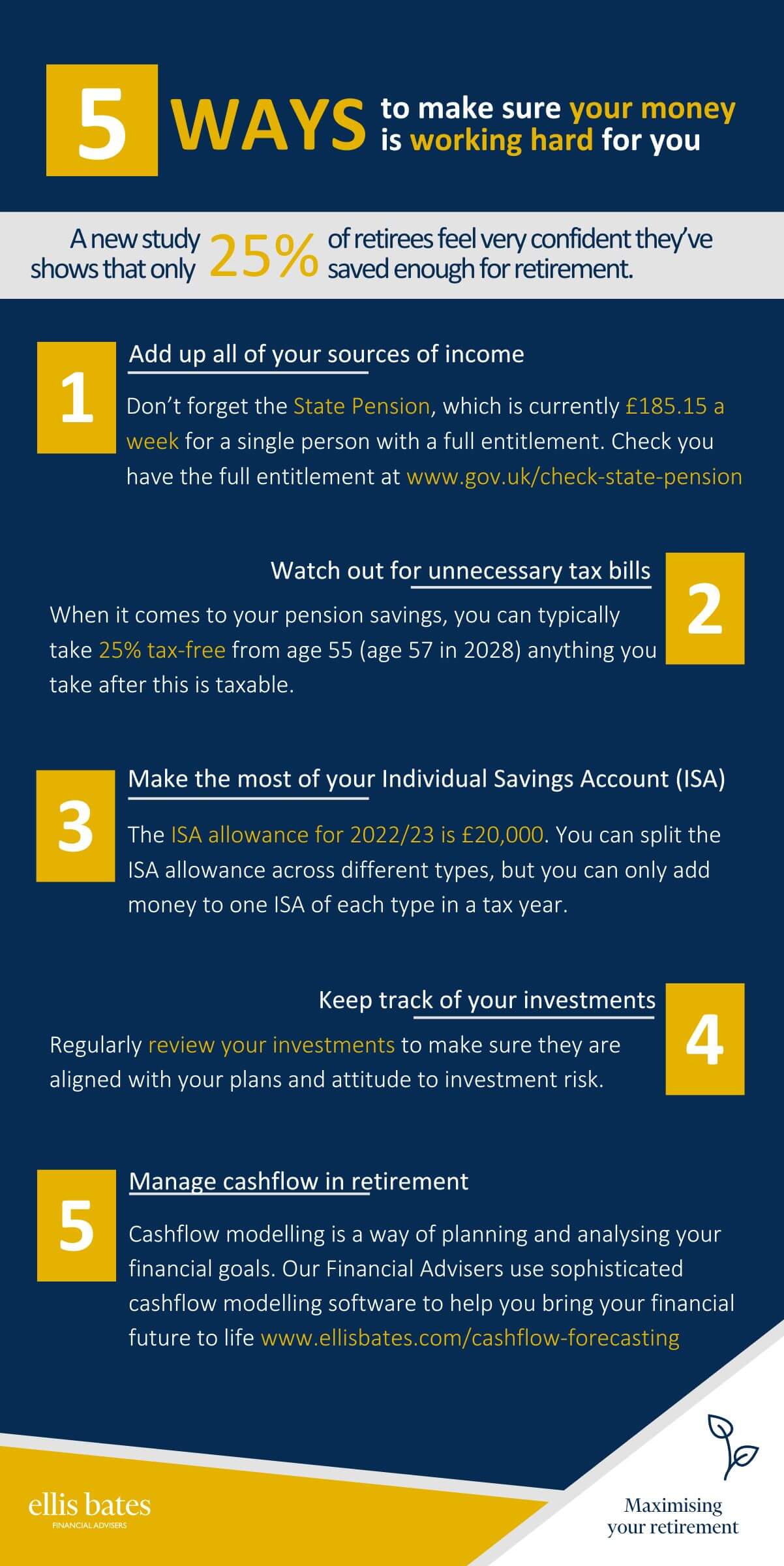

Fact: The government pays most UK adults over the pension age a State Pension, which is currently:

- Retired post-April 2016 full rate State Pension of £185.15 a week

- Retired pre-April 2016 full rate basic State Pension of £141.85 a week (a top-up is available for some, called the Additional State Pension)Not everyone is eligible for the full amount, which requires you to have at least 35 qualifying years on your National Insurance record. If you have less than ten qualifying years on your record, you’ll receive nothing. Even if you receive the full amount, you’ll usually need to supplement it with your own pension savings.

Myth: Your employer pays your pension

Fact: Most people are automatically enrolled into a workplace pension. Your employer is usually required to pay a minimum of 3% of your salary into it and you must also pay a minimum of 5% of your salary. If you keep your contributions at the minimum level, it might be difficult to save enough for retirement.

As life expectancies grow longer, your retirement can be almost as long as your working life. It’s therefore important to put aside a portion of your earnings to create a pension pot that will enable you to receive the income and live the lifestyle you want during retirement.

Myth: You can’t save more than your lifetime allowance

Fact: There is a lifetime allowance on the benefits you can access from your pension, which is currently £1,073,100 (tax year 2022/23). That doesn’t mean that you can’t withdraw any more after that, but it does mean that you’ll pay a tax charge of up to 55%. However, it was announced in the Spring Budget 2023 that this will be abolished from April 2023.

Myth: Your pension provider’s default fund is suitable for everyone

Fact: Most pension default funds will start out with a high-risk strategy and steadily move your capital into lower-risk investments, such as bonds and cash, as you get closer to retirement. This is to reduce volatility in the value of your investments so that you can have a higher degree of confidence in how much you’ll eventually end up with.

If you don’t plan to purchase an annuity, you don’t necessarily need to reduce volatility before retirement. You may be leaving some of your money invested for several more decades, in which case a higher risk strategy may be more appropriate.

Myth: Annuities are outdated

Fact: There was a time when almost everyone bought an annuity when they retired, and that time has passed because there are now alternative ways to access your pension savings. But annuities still have a useful role for generating a retirement income and can be an appropriate product for some people. Unlike other pension withdrawal methods, such as drawdown, an annuity offers a fixed income for life, so there’s no risk of your money running out. That’s a crucial benefit for many pensioners.

Myth: You can’t pass on a pension

Fact: If you’ve used your pension savings to purchase an annuity, the income from this will usually cease when you die. But if you have pension savings that you haven’t used to buy an annuity (for example, if you’ve been taking an income through drawdown), what’s left can be passed on to a loved one. If you die before the age of 75 there will usually be no tax to pay by the beneficiary. Otherwise, they will need to pay Income Tax according to their tax band.

Get in touch

If you would like more information on our pension planning services or are looking for financial advice, then please book a chat.