Market commentary: Navigating potential slowdowns

https://www.ellisbates.com/wp-content/uploads/2024/10/Picture4.png 794 576 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=g Navigating potential slowdowns and corrections as investors grapple with mixed signals from economic indicators

Navigating potential slowdowns and corrections as investors grapple with mixed signals from economic indicators

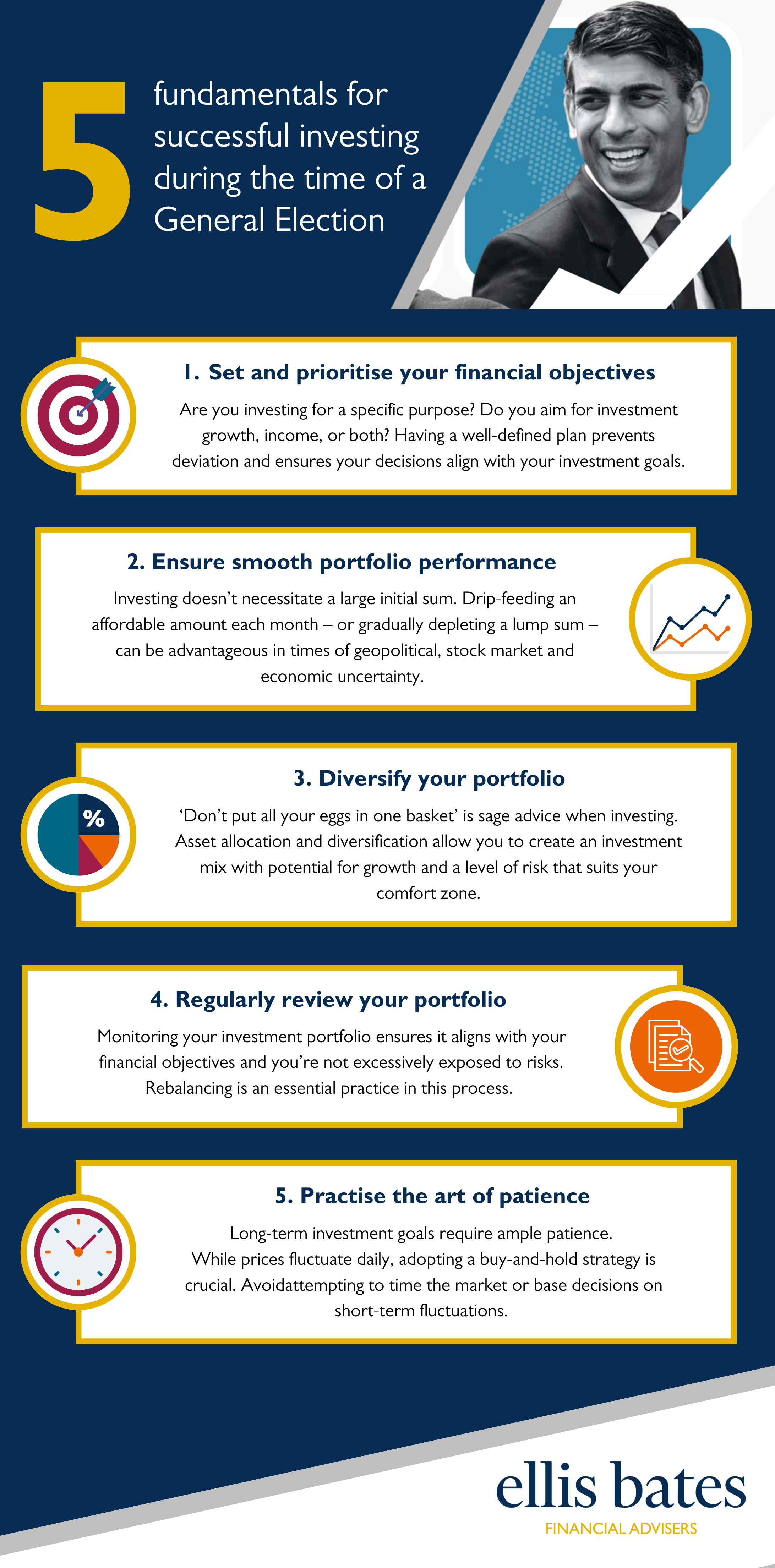

The previous quarter has revealed a complex tapestry of global market dynamics, underscored by a notable downturn in equities during August. This period has been marked by a convergence of factors, including economic vulnerabilities in the US, which have sent ripples through global markets. Understanding these trends becomes paramount in navigating potential slowdowns and corrections as investors grapple with mixed signals from economic indicators like inflation and consumer confidence.

The UK experienced a dramatic swing in market sentiment, initially buoyed by political optimism following a major electoral shift. However, this enthusiasm was quickly overshadowed by broader economic concerns and geopolitical tensions, leading to a slump in equities. This underscores the unpredictable nature of market dynamics and the need for a diversified approach to withstand such volatility.

In the Eurozone, resilience in specific sectors was offset by political uncertainties and regional disparities, particularly highlighted by Germany’s economic contraction. The mixed economic data and political stalemates necessitate a vigilant approach to understanding local and regional market influences, with an eye on potential opportunities amidst these challenges.

The US market reflected a similar narrative, with gains in July overshadowed by August’s downturn. While potential interest rate cuts offered some hope, the overarching concerns of a recession and political shifts added complexity to market dynamics. This highlights the intricate interplay of economic and political factors that investors must consider when strategising their portfolios.

Japan’s experience during this period illustrates the challenges and opportunities within a volatile market landscape. Currency fluctuations and central bank actions significantly impacted various sectors, necessitating strategic diversification and a focus on value-oriented investments. This serves as a reminder of the importance of adapting to changing market conditions through informed investment decisions.

Overall, the global bond market’s performance in July, followed by challenges in August, emphasises the ever-changing nature of economic landscapes. Maintaining a diversified investment strategy, being vigilant and understanding market trends are critical for investors to effectively manage risks and capitalise on opportunities in this complex environment. As we move forward, continuous monitoring and strategic positioning will be essential in navigating the evolving global economy.

For a full breakdown, please click here download our Quarterly Market Commentary.

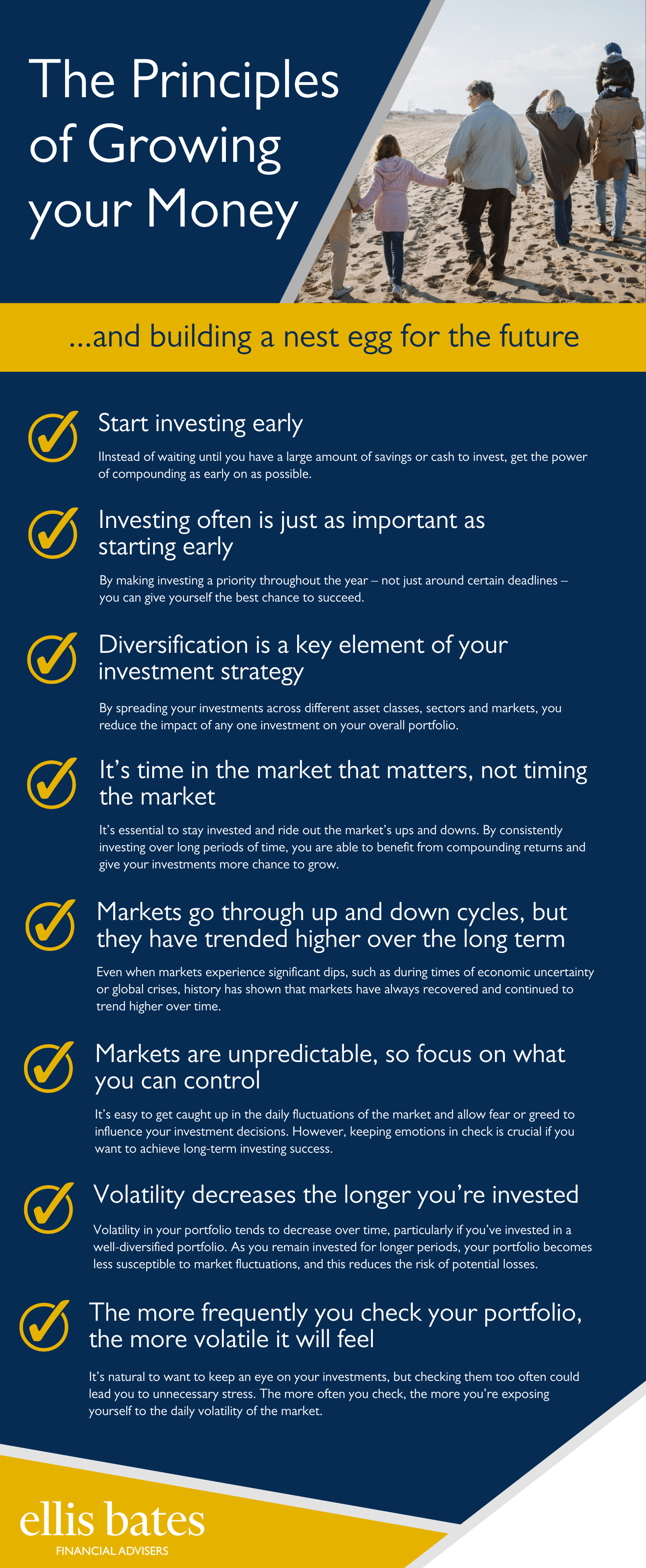

Research shows that many individuals have not saved sufficiently for their retirement, so they are becoming increasingly reliant on stock market returns to maintain their lifestyle after they finish working. However, volatility in the markets post-COVID has raised concern over expectations of market returns in the years ahead. This leaves investors vulnerable to market shocks.

Research shows that many individuals have not saved sufficiently for their retirement, so they are becoming increasingly reliant on stock market returns to maintain their lifestyle after they finish working. However, volatility in the markets post-COVID has raised concern over expectations of market returns in the years ahead. This leaves investors vulnerable to market shocks.