COP27

https://www.ellisbates.com/wp-content/uploads/2022/11/COP27-blog.jpg 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=g By Kim Holding, Portfolio Manager

By Kim Holding, Portfolio Manager

On 6 November, the 27th Conference of the Parties (the name given to the United Nations’ annual climate change conferences) began. Hosted this year by Egypt, COP is an important platform for nations to discuss and reach consensus on how to protect the world in terms of environmental issues. This year’s summit is expected to be a crucial point in the fight against climate change, as it seeks renewed solidarity between countries to deliver on their previously agreed pledges. Further, due to the scale of its potential impact, climate change takes a global effort so coordinated action is crucial.

Environmental issues have been at the centre of society’s concerns since the 1980s following disasters such as Chernobyl and the Exxon Valdez oil spill. In more recent years, climate change has been rising up public agendas. Further pressure to take action came in 2021 when the Intergovernmental Panel on Climate Change (IPCC) reported that unsustainable human behaviours (such as burning fossil fuels) have caused global temperatures to increase by 1.2°C since the 1850s, which is worryingly close to the globally agreed target of 1.5°C. According to the IPCC, this rise has damaged our planet in unprecedented ways which is, in turn, disrupting food and fresh water supplies, significantly impacting on our health and wellbeing, and putting life (both on land and at sea) at risk; and, further, that some of these effects are ‘irreversible’. Temperatures are expected to continue to rise, unless those unsustainable behaviours are addressed and greenhouse gas emissions are significantly reduced.

That said, temperature rises are not uniform across the globe, with some locations warming faster than others. Scientific research indicates that several of the world’s developing regions are contributing less to climate change, yet they are more vulnerable to its impacts, and in this regard they will continue to face much greater risks in the years ahead. One of the most widely publicised examples of 2022 is Pakistan which, following torrential monsoon rains over the summer, experienced the most severe flooding in its modern history, washing away villages and affecting millions of people; yet the country contributes less than 1% of the global carbon footprint. Another example is Africa, where large parts of Ethiopia, north-eastern Kenya and Somalia are currently facing their worst droughts for over four decades, yet the continent accounts for only 3-4% of global greenhouse gases. In contrast, approximately a quarter of emissions come from China, followed by about 12% from the US.

This non-uniformity of temperature rises is expected to be a key focal point at COP27 where world leaders, some of the world’s most influential businesses, environmental and faith groups, policymakers and think tanks are in attendance. While China, among other high-emitting countries, will not be at the summit, they – along with the US and other rich nations – are being urged to increase their financial aid to poorer countries. In doing so, this will allow the latter to deal with the impacts of climate change – for example, to establish green energy systems (to cut their own greenhouse gas emissions) and to improve their infrastructure (so they may adapt to hotter conditions).

This all comes at a time, though, when Russia’s invasion of Ukraine is putting increased economic strains on developed countries. That said, according to the International Monetary Fund (IMF) in its October assessment of the world economy, a timely and credible green transition is not only critical for our planet’s future but will also help macroeconomic stability, since the relinquishment by nations of their reliance on Russia’s fossil fuels will enable a quick transition to clean energy, simultaneously putting them more in control of their own destiny with regard to energy prices. Thus, COP27 could represent a historic turning point in the global energy crisis and in the fight against climate change.

Companies demonstrating poor practices – whether they are damaging to the environment, have poor human rights records, or are poorly managed – are more likely to fail and won’t be around in years to come, so from an investment perspective, diligent investors simply will not look to invest. For this reason, we incorporate environmental, social and governance (ESG) considerations across all our portfolios, and SRI has always formed a fundamental part of our investment process. Our SRI portfolios provide our clients with a more targeted approach in tackling the world’s challenges, and every fund we hold must demonstrate that a socially responsible investment culture is intrinsic to their approach.

For more information on our SRI portfolios, visit our Socially Responsible Investing page at https://www.ellisbates.com/socially-responsible-investing/.

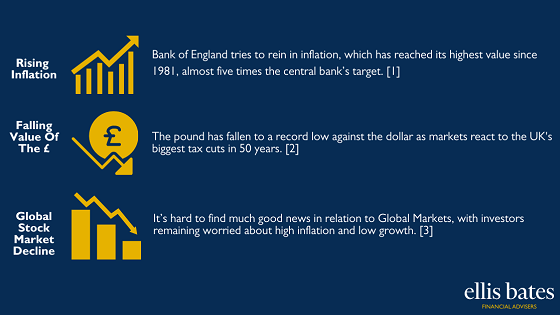

Why now is the time to make sure you protect your wealth.

Why now is the time to make sure you protect your wealth.