Investing during the time of a General Election

https://www.ellisbates.com/wp-content/uploads/2024/06/Picture2-1024x651.png 1024 651 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=g

Set and prioritise your financial objectives

Your investment journey requires a clear plan, which includes understanding your unique goals and the strategies to achieve them.

Are you investing for a specific purpose? Do you aim for investment growth, income, or both? Having a well-defined plan prevents deviation and ensures your decisions align with your investment goals.

Remember, there’s no universal approach to achieving financial objectives. Your goals should reflect your individual circumstances, preferences and ambitions. By identifying and prioritising your financial objectives, you can concentrate on what’s most important in a sequence that suits you. This step also guides you in making necessary compromises.

Ensure smooth portfolio performance

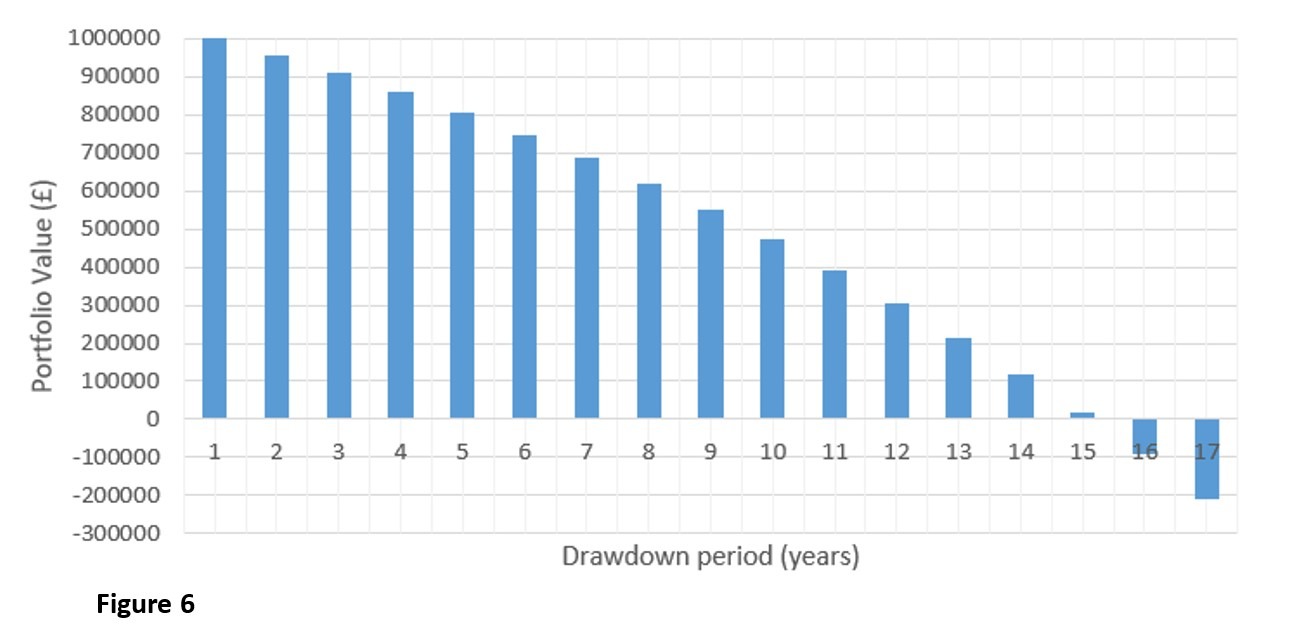

Investing doesn’t necessitate a large initial sum. Drip-feeding an affordable amount each month – or gradually depleting a lump sum – can be advantageous in times of geopolitical, stock market and economic uncertainty. Known as pound cost averaging, this can offer a safeguard against value depreciation in markets that inherently have the propensity to decline and ascend.

Rather than committing a substantial amount of money at a single market point, which a price drop could potentially follow, regular investments would purchase units as the prices of the underlying assets decrease. This could lead to obtaining more units for your capital, resulting in a higher return if the market situation becomes favourable and prices start rising.

Diversify your portfolio

‘Don’t put all your eggs in one basket’ is sage advice when investing.

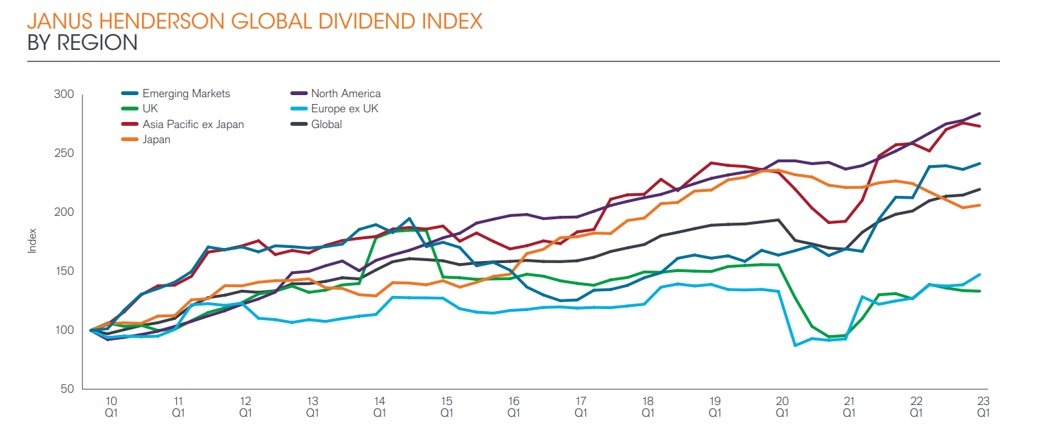

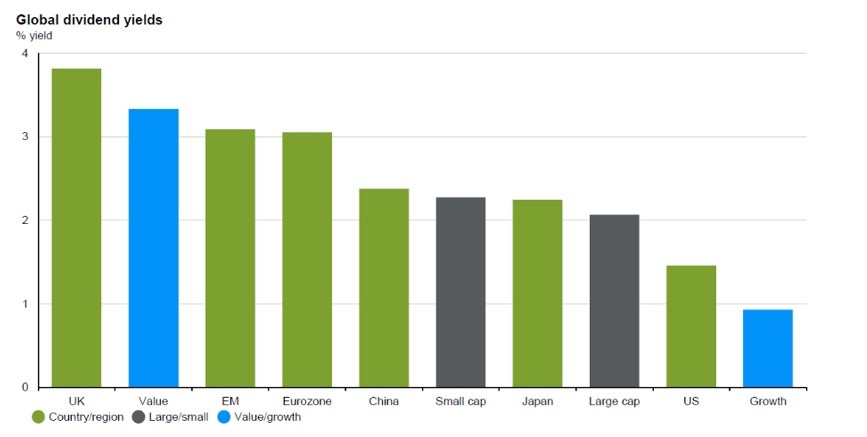

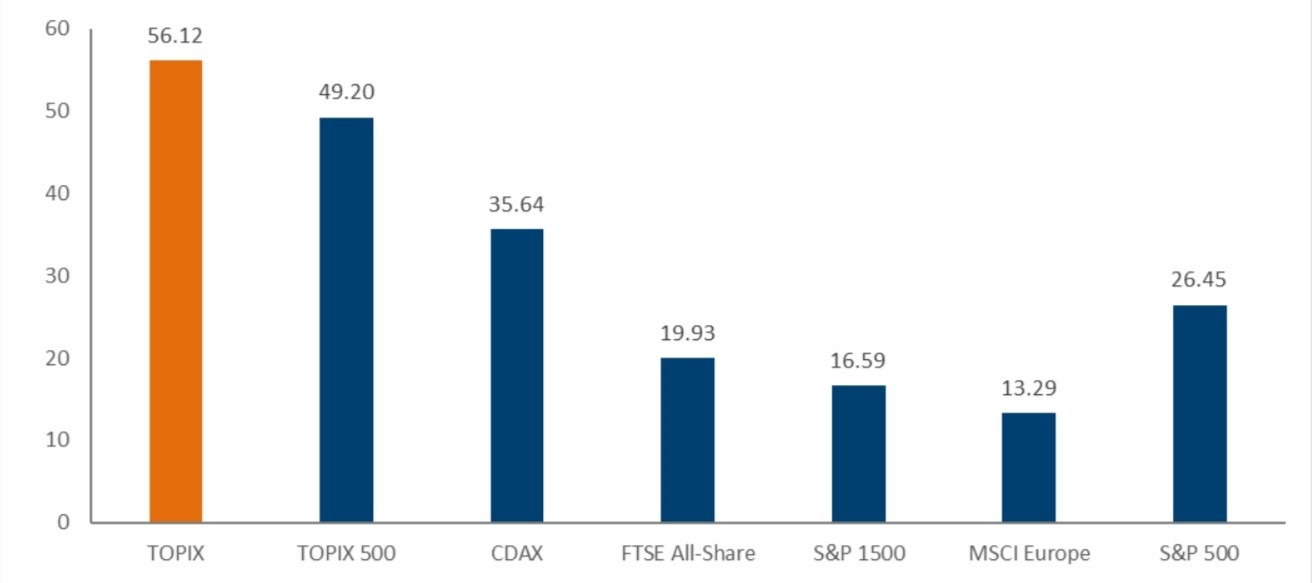

Diversification spreads risk across various investments and sectors, helping you navigate market volatility. Asset allocation and diversification allow

you to create an investment mix with potential for growth and a level of risk that suits your comfort zone.

In a diversified portfolio, the less correlated the assets, the better. The concept is straightforward: if you invest everything in one sector – like technology – and it plummets due to regulatory changes, your investment suffers too.

Regularly review your portfolio

Monitoring your investment portfolio ensures it aligns with your financial objectives and you’re not excessively exposed to risks. Rebalancing is an essential practice in this process. It involves adjusting the allocations of different assets within your portfolio to maintain the ‘weight’ or proportion that best matches your initial investment goal.

Market performance can cause the value of each holding in your portfolio to rise or fall over time, altering its proportion within the overall portfolio. As these proportions deviate from their original weightings, the risk profile of your portfolio changes accordingly.

High-return assets typically carry higher risk, meaning these high-risk investments may increasingly dominate your portfolio over extended periods, elevating your risk level beyond your initial plan.

Practise the art of patience

Long-term investment goals require ample patience. While prices fluctuate daily, adopting a buy-and-hold strategy is crucial. Avoid attempting to time the market or base decisions on short-term fluctuations. Market timing – predicting changes in stock prices or index values – often leads to poor decision-making.

Instead, focus on your overall investment goals and adhere to your plan. As many investors say, ‘There are only two types of people when it comes to market timing: those who can’t do it, and those who haven’t realised they can’t.’ If you’re patient enough to ignore the noise, the market will eventually recognise an asset’s underlying value.

If you’d like to know more about how the general election could impact your finances and investments, download our free election guide:

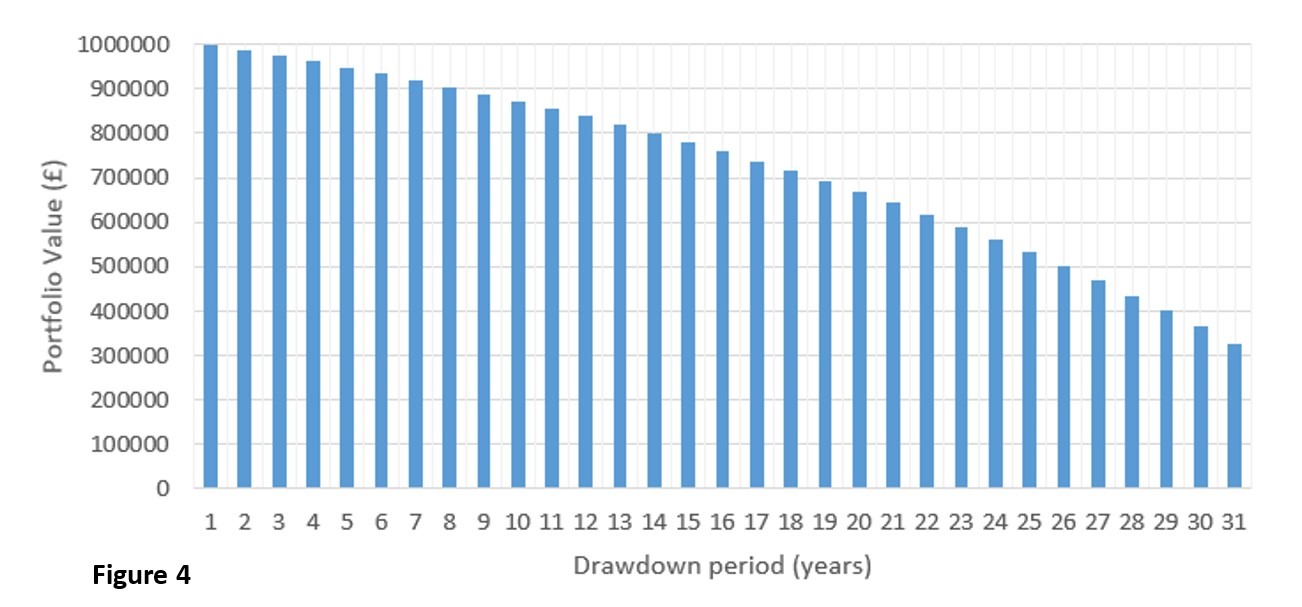

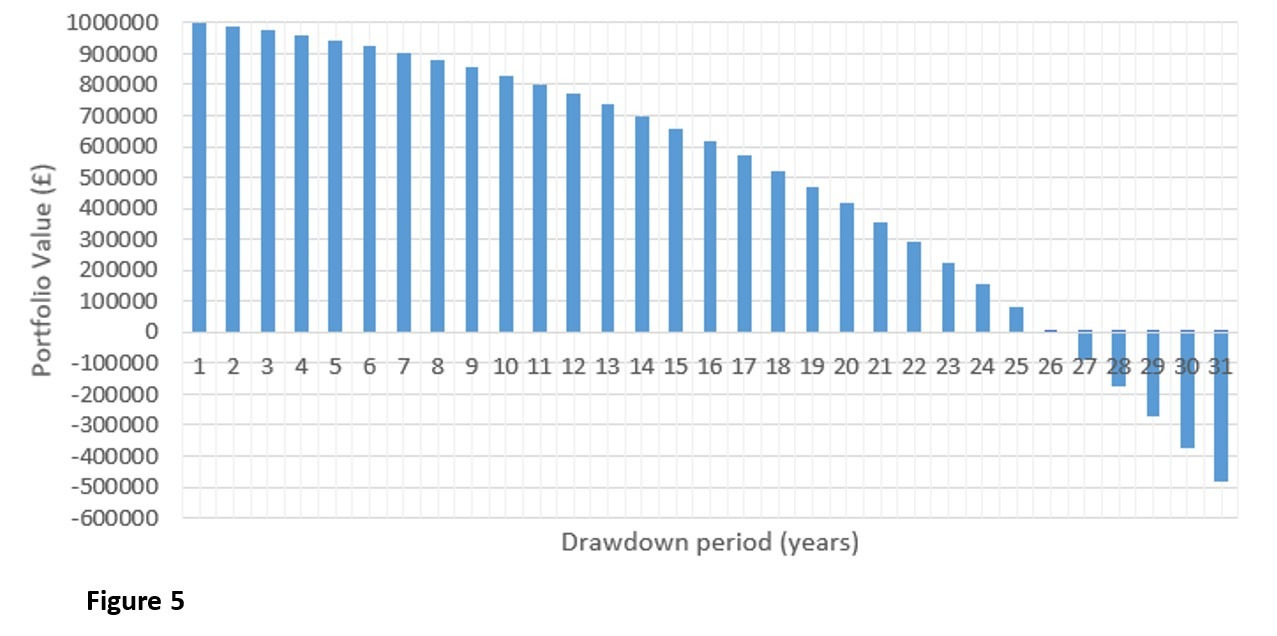

Research shows that many individuals have not saved sufficiently for their retirement, so they are becoming increasingly reliant on stock market returns to maintain their lifestyle after they finish working. However, volatility in the markets post-COVID has raised concern over expectations of market returns in the years ahead. This leaves investors vulnerable to market shocks.

Research shows that many individuals have not saved sufficiently for their retirement, so they are becoming increasingly reliant on stock market returns to maintain their lifestyle after they finish working. However, volatility in the markets post-COVID has raised concern over expectations of market returns in the years ahead. This leaves investors vulnerable to market shocks.