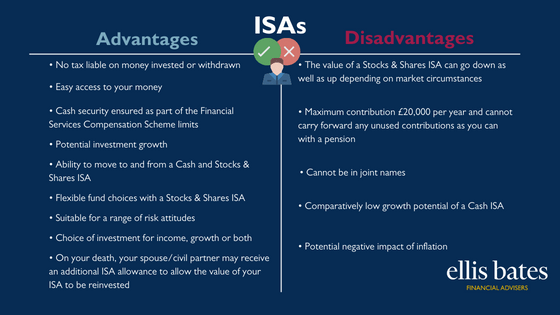

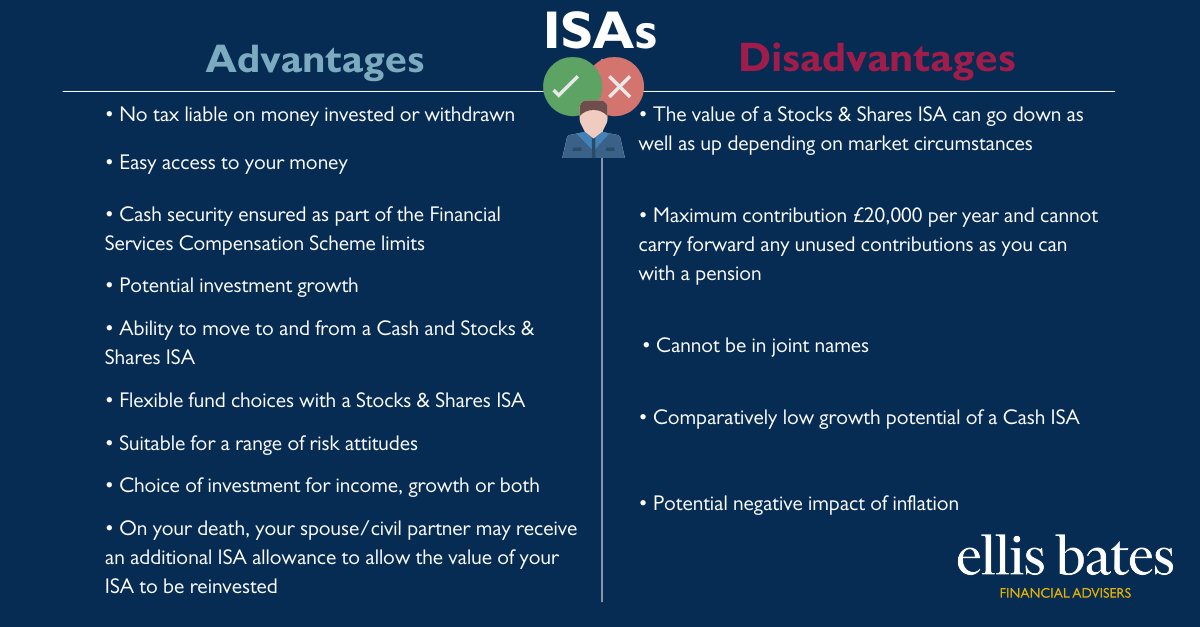

Advantages & Disadvantages of ISAs

https://www.ellisbates.com/wp-content/uploads/2022/10/Isas-dis-adv-smaller.png 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=g

ISAs are a type of savings plan where you can pay in lump sums and/or regular contributions. There are both advantages and disadvantages to having an ISA.