COP27 Goals & Vision

https://www.ellisbates.com/wp-content/uploads/2022/11/COP27-Goals-and-Vision-560-×-315px.png 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=g

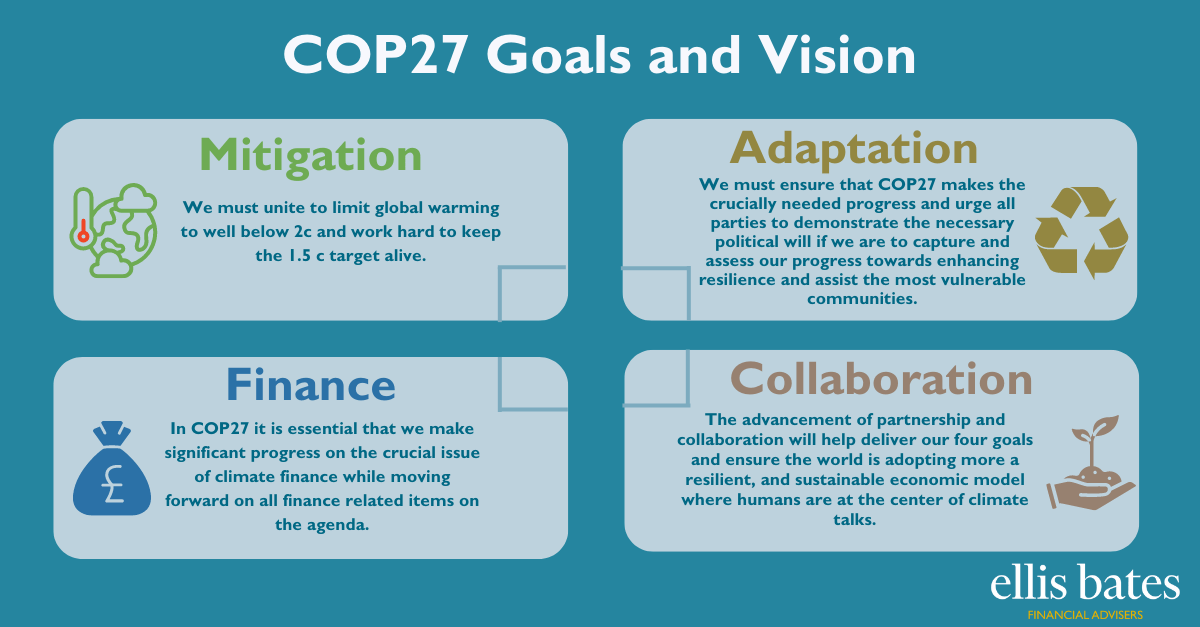

COP27 Goals and Vision

Mitigation

We must unite to limit global warming to well below 2c and work hard to keep the 1.5c target alive.

Adaption

We must ensure that COP27 makes the crucially needed progress and urge all parties to demonstrate the necessary political will if we are to capture and assess our progress towards enhancing resilience and assist the most vulnerable communities.

Finance

In COP27 it is essential that we make significant progress on the crucial issue of climate finance while moving forward on all finance related items on the agenda.

Collaboration

The advancement of partnership and collaboration will help deliver our four goals and ensure the world is adopting more a resilient, and sustainable economic model where humans are at the center of climate talks.

Source: https://cop27.eg/#/vision

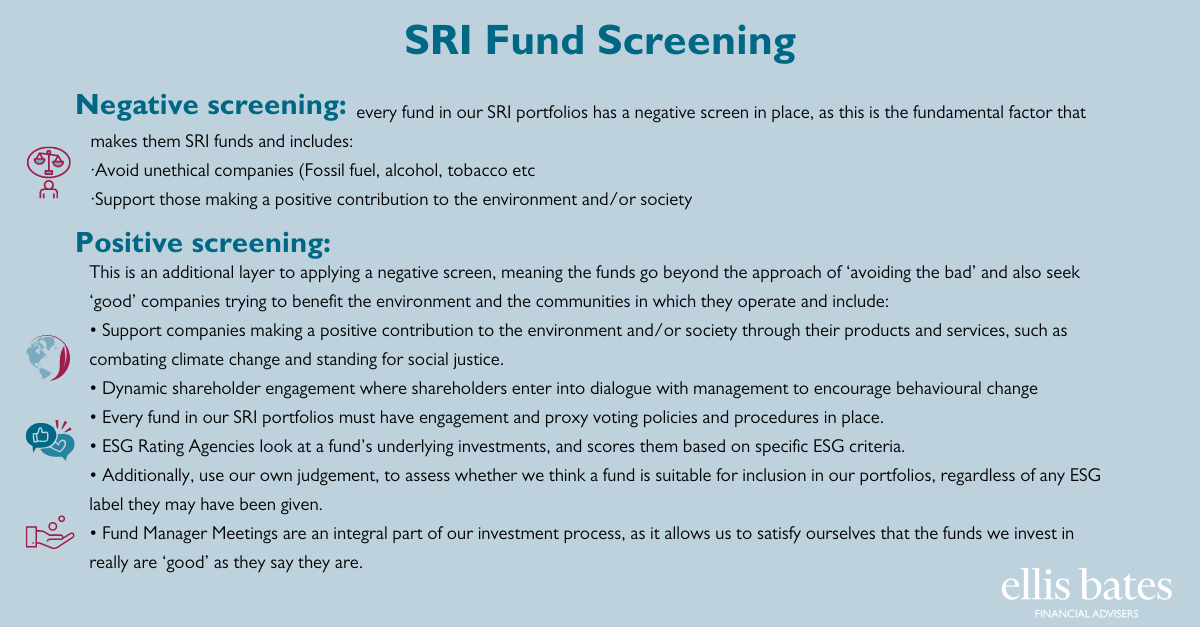

Socially Responsible Investing with Ellis Bates

For more information on our SRI portfolios, visit our Socially Responsible Investing page at https://www.ellisbates.com/socially-responsible-investing/.

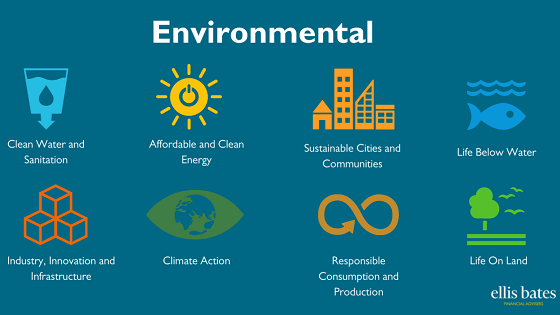

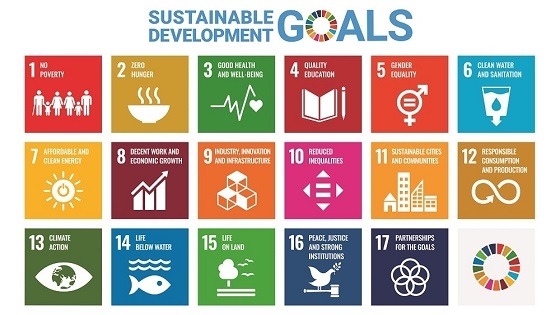

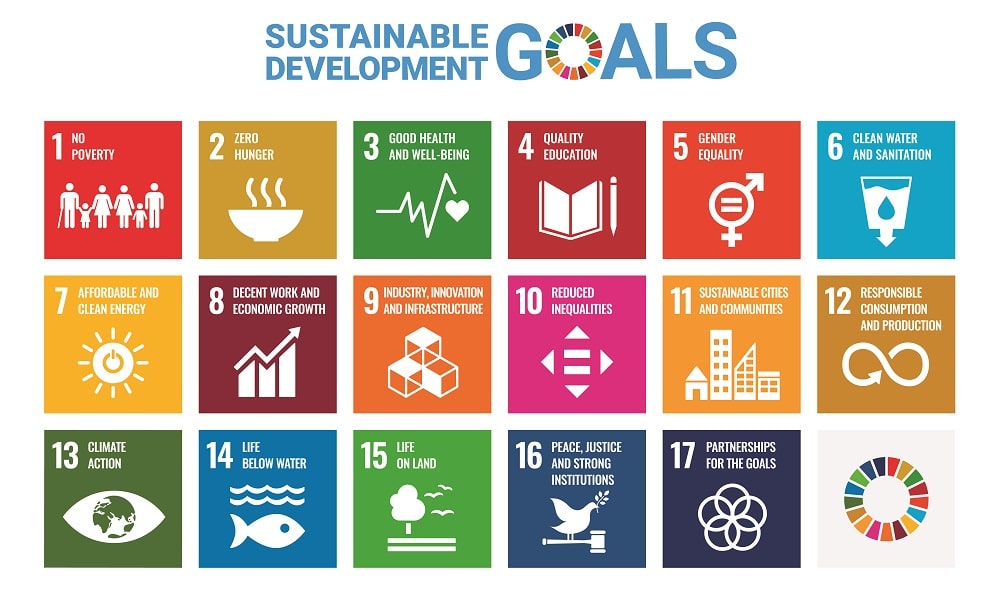

The 2030 Agenda for Sustainable Development, adopted by all United Nations Member States in 2015, provides a shared blueprint for peace and prosperity for people and the planet, now and into the future. As part of our commitment to our clients, as socially responsible investors we are committed to supporting the SDGs, so much so that every single fund we hold can easily be associated with one or more of these goals.

The 2030 Agenda for Sustainable Development, adopted by all United Nations Member States in 2015, provides a shared blueprint for peace and prosperity for people and the planet, now and into the future. As part of our commitment to our clients, as socially responsible investors we are committed to supporting the SDGs, so much so that every single fund we hold can easily be associated with one or more of these goals.