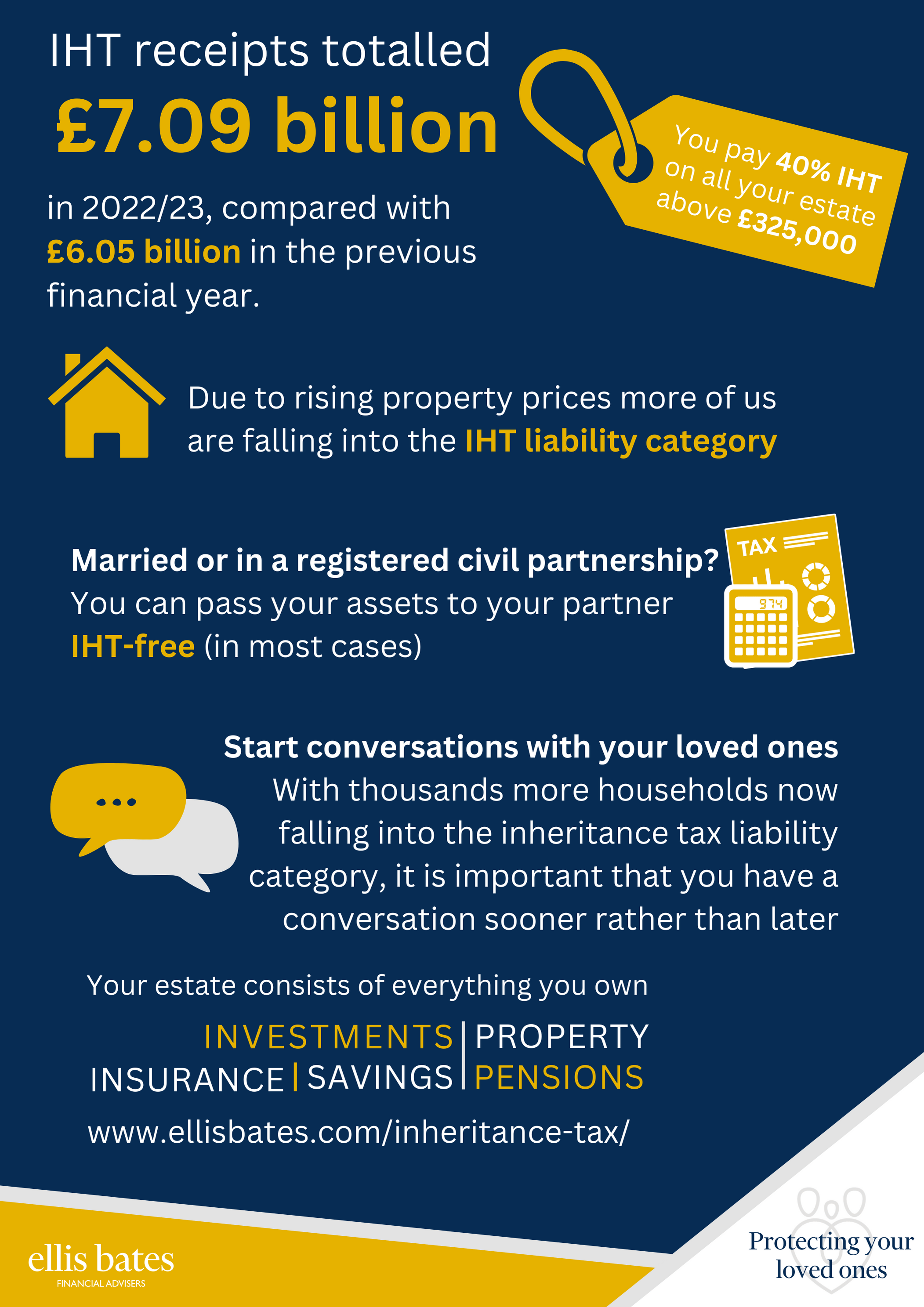

The UK Treasury has been receiving record-breaking Inheritance Tax (IHT) receipts. IHT receipts amounted to approximately £7.09 billion in 2022/23, compared with £6.05 billion in the previous financial year.

Due to rising property prices more of us are falling into the IHT liability category

Are you married or in a registered civil partnership?

You can pass your assets to your partner IHT-free (in most cases)

Start conversations with your loved ones

With thousands more households now falling into the inheritance tax liability category, it is important that you have a conversation sooner rather than later

Your estate consists of everything you own including:

- Life insurance

- Investments

- Property

- Savings

- Pensions

To find out about our Inheritance Tax planning services, please get in touch.