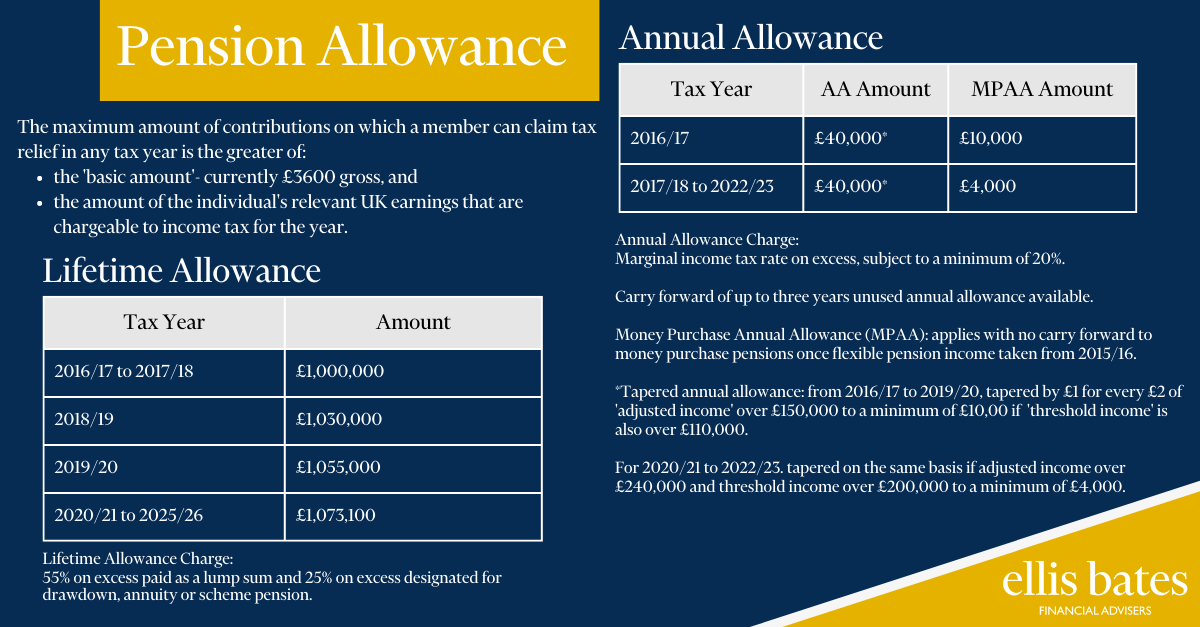

Pension Allowance

The maximum amount of contributions on which a member can claim tax relief in any tax year is greater of:

- the ‘basic amount’ – currently £3600 gross, and

- the amount of the individual’s relevant UK earnings that are chargeable to income tax for the year.

Lifetime Allowance

| Tax Year | Amount |

| 2016/17 to 2017/18 | £1,000,000 |

| 2018/19 | £1,030,000 |

| 2019/20 | £1,055,000 |

| 2020/21 to 2025/26 | £1,073,100 |

Lifetime Allowance Charge: 55% on excess paid as a lump sum and 25% on excess designated for drawdown, annuity or scheme pension.

Annual Allowance

| Tax Year | AA Amount | MPAA Amount |

| 2016/17 | £40,000* | £10,000 |

| 2017/18 to 2022/23 | £40,000* | £4,000 |

Annual Allowance Charge: Marginal income tax rate on excess, subject to a minimum of 20%.

Carry forward of up to three years unused annual allowance available.

Money Purchase Annual Allowance (MPAA): applies with no carry forward to money purchase pensions once flexible pension income taken from 2015/16.

*Tapered annual allowance: from 2016/17 to 2019/20, tapered by £1 for every £2 of ‘adjusted income’ over £150,000 to a minimum of £10,000 if ‘threshold income’ is also over £110,000.

For 2020/21 to 2022/23, tapered on the same basis if adjusted income over £240,000 and threshold income over £200,000 to a minimum of £4,000.