Preparing for retirement

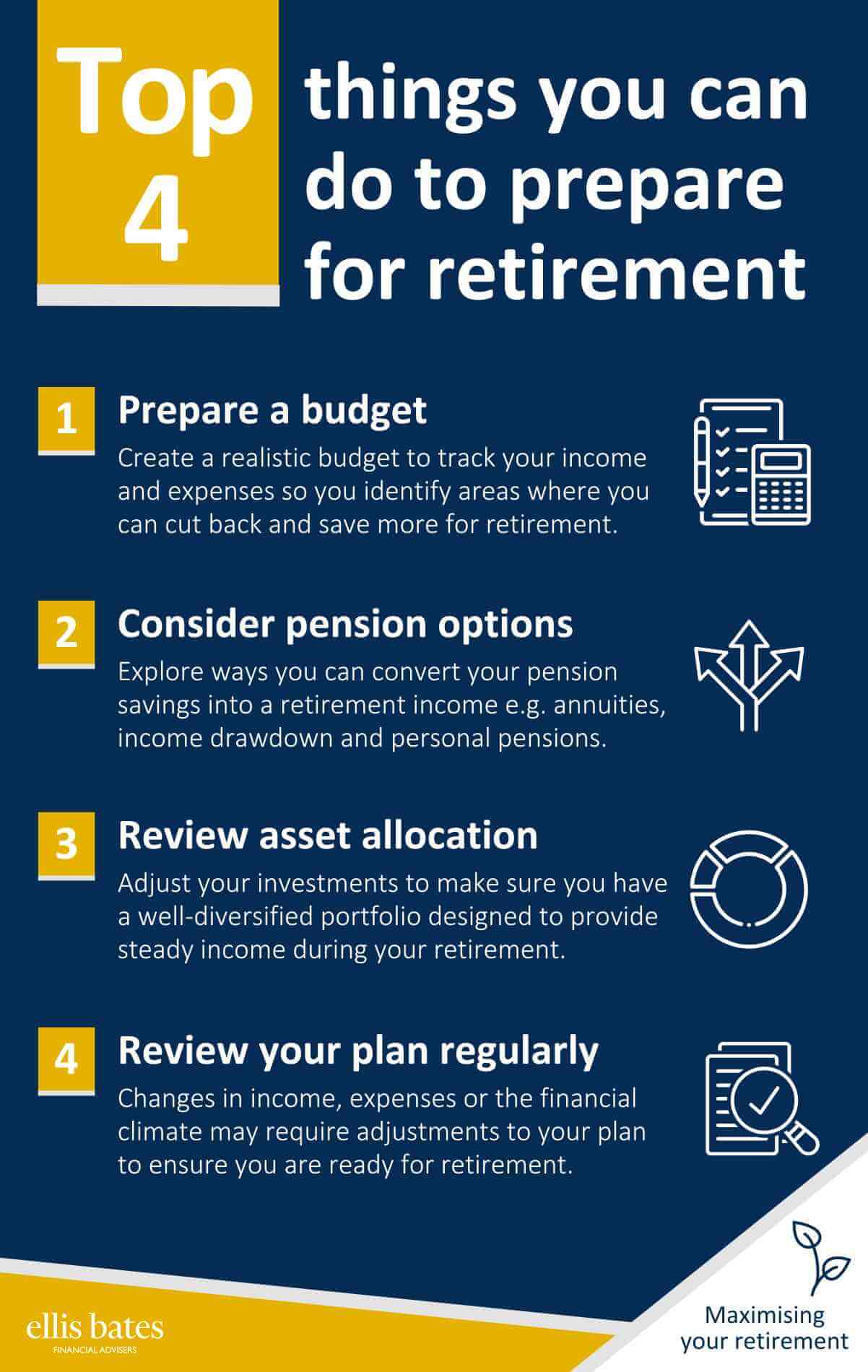

Here are the top four things you can do to prepare for retirement:

1. Prepare a budget

One of the most important things you can do is to create a realistic budget that will help you track your expenses and income. This will allow you to identify any areas where you can cut back and save more money for retirement. By tracking your spending and income, you can create a plan that helps you save for a comfortable retirement.

2. Consider pension decumulation options

As you approach retirement age, it’s essential to explore the various ways you can convert your pension savings into a retirement income. There are several options available, such as annuities, income drawdown and immediate vesting personal pensions. Seeking professional financial advice will help you understand your options better and make informed decisions about how to access your pension.

3. Review your asset allocation

As retirement approaches, it’s essential to reduce exposure to higher-risk assets such as equities. By reviewing your asset allocation, you can adjust your investments to make sure you have a well-diversified portfolio that is designed to provide steady income for your retirement years.

4. Review your retirement plan regularly

Regularly reviewing your progress is crucial to ensure you are ready for retirement and make the necessary adjustments if needed. Changes in your income, expenses or the financial climate may require you to adjust your plan. By following these four tips, you can set yourself on a path to financial security for your retirement years.

Seek professional financial advice

By planning ahead and taking the necessary steps, we can help you build a robust retirement plan. To tell us about your retirement planning goals and discover how we can help you, please book a chat. Alternatively, watch our video on “the benefits of financial advice when planning retirement“.