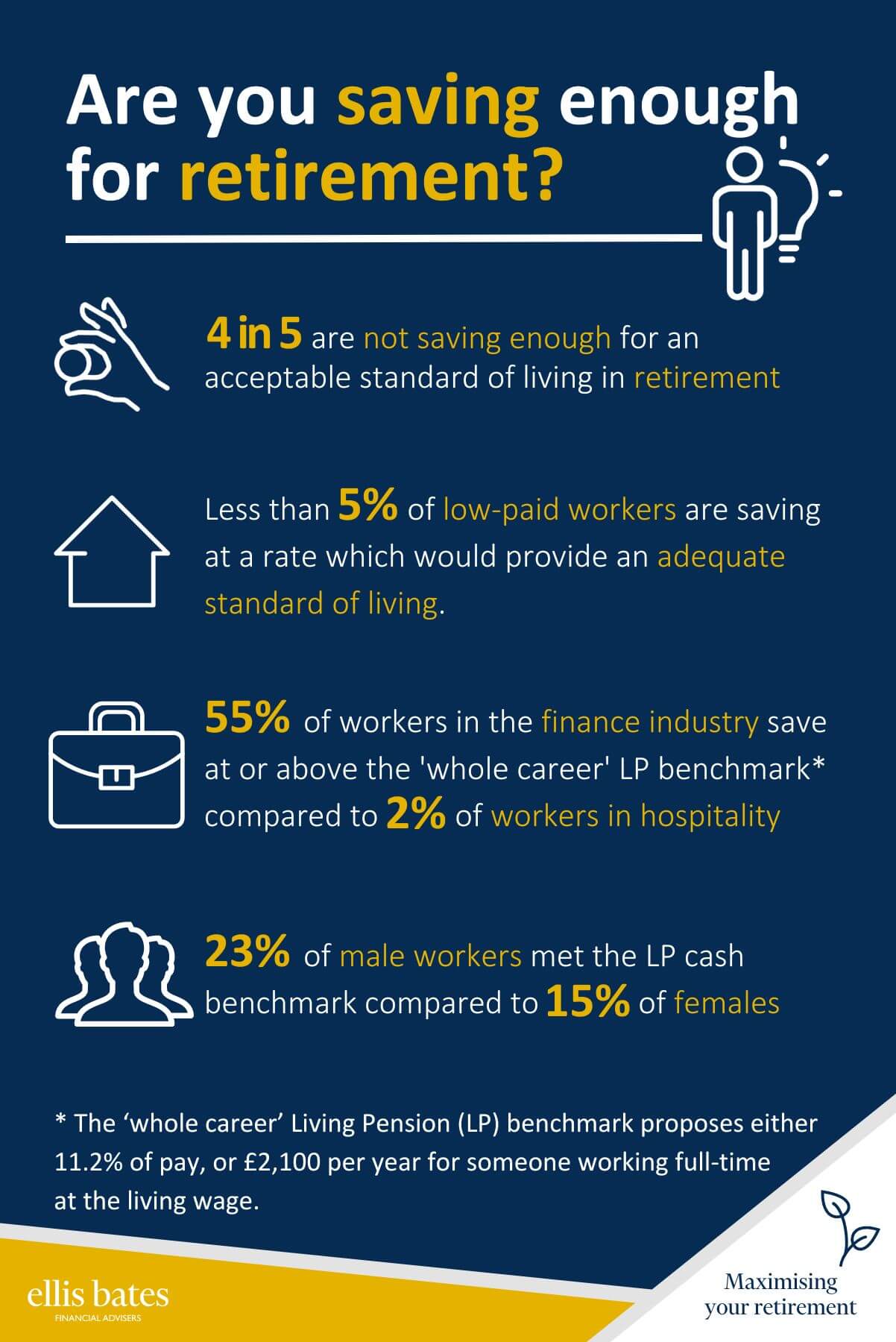

- 4 in 5 are not saving enough for an acceptable standard of living in retirement

- Less than 5% of low-paid workers are saving at a rate which would provide an adequate standard of living

- 55% of workers in the finance industry save at or above the ‘whole career’ LP benchmark compared to 2% of workers in hospitality. The ‘whole career’ Living Pension (LP) benchmark proposes either 11.2% of pay, or £2,100 per year for someone working full-time at the living wage.

- 23% of male workers met the LP cash benchmark compared to 15% of females

For more information on our retirement planning services, please get in touch.

Source data: [1] https://www.livingwage.org.uk/sites/default/files/Living%20Pensions%20Report.pdf