Coming into effect on 31 July, the Sustainability Disclosure Requirements (SDR) represent a significant regulatory change aimed at enhancing transparency and accountability in the fund management industry.

Why is this necessary? Over the years, environmental and social challenges – such as climate change and wealth inequality – have become increasingly important to investors, resulting in growing demand for socially responsible products.

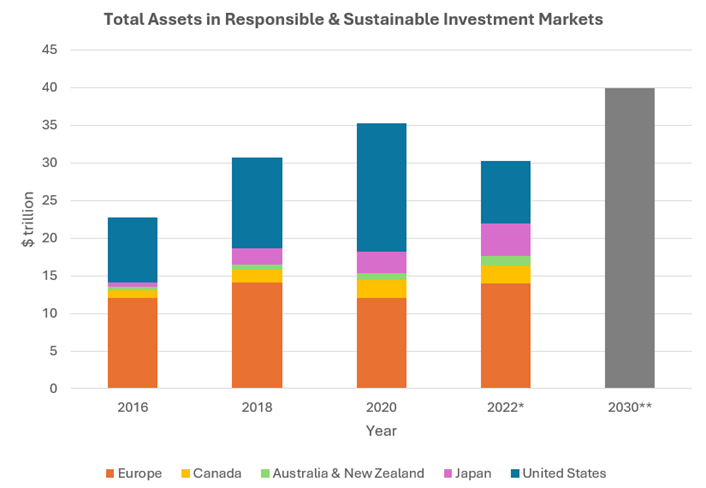

To illustrate the substantial increase in demand from an investment perspective, we can turn to data from the Global Sustainable Investment Alliance (GSIA), a consortium of membership-based sustainable investment organisations around the world. According to their latest biennial Investment Review[1], assets in responsible and sustainable investment markets reached $30.3 trillion worldwide in 2022 – or a 33% increase compared with the $22.8 trillion recorded in 2016, and similar trends are evident in data from other reputable sources. Despite difficult market conditions for responsible and sustainable assets over the past two years (coinciding with higher inflation and higher interest rates), the growth of these assets appears set to continue. Predictions suggest that they could surpass $40 trillion by 2030[2].

* The apparent reduction in US sustainable investment assets under management between 2020 and 2022 is explained by the adoption of revised methodology in determining what constitutes a sustainable fund.

** Data for 2030 is estimated.

To tap into this trend, in recent years companies and fund houses have been rolling out new products with a sustainable tilt, or saying that they are embracing environmental, social and governance (ESG) principles. While many of these organisations have been using growing demand to improve their business practices, others have been accused of greenwashing: the practice of making misleading environmental claims for marketing purposes, ultimately to increase profits.

To address greenwashing, the UK regulator – the Financial Conduct Authority (FCA) – has introduced the Sustainability Disclosure Requirements (SDR). The aim is to make it clearer for consumers to understand the environmental and social impacts of the products that they are buying, by setting standardised disclosure rules.

Products within the SDR’s scope may voluntarily apply one of four labels – Sustainability Focus, Sustainability Improvers, Sustainability Impact or Sustainability Mixed Goals – that accurately reflects their sustainability characteristics. Each label has its own very clear and distinct criteria, so firms need to choose carefully to ensure accurate representation. Where a label is assigned, then firms must provide various disclosures on an ongoing basis that detail the sustainability characteristics of those products. In any cases where a firm misuses a label, makes misleading disclosures and/or ignores the requirement to make the necessary disclosures, then the FCA has the authority to take enforcement action, including financial penalties and sanctions – this is the first time that the FCA has been given such extensive powers over sustainability-related claims.

The SDR should therefore take transparency a step further in guiding consumers and investors toward environmentally and socially responsible choices. By implementing a comprehensive labelling system, the SDR ensures that products labelled as ‘sustainable’ genuinely represent their advertised characteristics, in turn enhancing trust in the market, and contributing to a more meaningful and measurable impact on environmental and social outcomes.

Implementation of the SDR also impacts our Ellis Bates Socially Responsible Investment (SRI) portfolios and we are communicating with the fund managers to ensure alignment with the new guidelines. To be eligible for inclusion in our SRI portfolios, funds must adhere to stringent criteria that fit with both the SRI and investment objectives of the strategy. Since launching our first SRI portfolio in 2008, this rigorous process has been central to our approach, and we continue to uphold our commitment to socially responsible investing.

[1] Global Sustainable Investment Alliance, 2023. Global Sustainable Investment Review 2022. Retrieved from https://www.gsi-alliance.org/wp-content/uploads/2023/12/GSIA-Report-2022.pdf (Accessed: June 2024)

[2] Bloomberg, February 2024. Global ESG assets predicted to hit $40 trillion by 2030, despite challenging environment, forecasts Bloomberg Intelligence. Retrieved from https://www.bloomberg.com/company/press/global-esg-assets-predicted-to-hit-40-trillion-by-2030-despite-challenging-environment-forecasts-bloomberg-intelligence/ (Accessed: June 2024)

If you would like to discuss Socially Responsible Investing with an Expert Financial Adviser, please get in touch