How much money do you need to retire at 60?

We are often asked this question and as a general rule of thumb you need 20 – 25 times your retirement expenses. So, if you spend £30,000 per year, you’ll need £600,000 – £750,000 in pensions, investments and savings to be able to retire.

Another top tip is that you should save 12.5 per cent of your monthly salary.

Try our handy calculator to help you understand the level of contributions you need to be making.

Retirement income

The most important question of all is are my pensions going to give me the income I want, when I want it? There are many statistics online to show you the average pot on retirement, what the State Pension will provide and what level of income this will deliver.

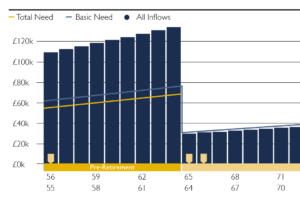

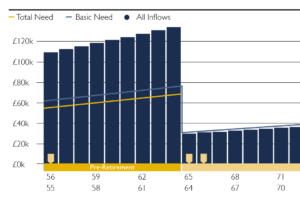

Cash flow forecasting

Cash flow forecasting

Our Advisors use sophisticated software to plot your own pension and retirement journey, showing you how much you have saved, how much more you need to save (be it pensions, ISA’s, other forms of savings or investments etc) and your income and expenditure needs.

Your Advisor will work with you to create an interactive model which will be reviewed and adjusted with each change in your circumstances.

Read more about managing cashflow in retirement.

We are here to help you achieve your retirement goals with expert pension planning and outlining how much you should be saving to get the best possible income in retirement.

We are here to help you achieve your retirement goals with expert pension planning and outlining how much you should be saving to get the best possible income in retirement.

Cash flow forecasting

Cash flow forecasting