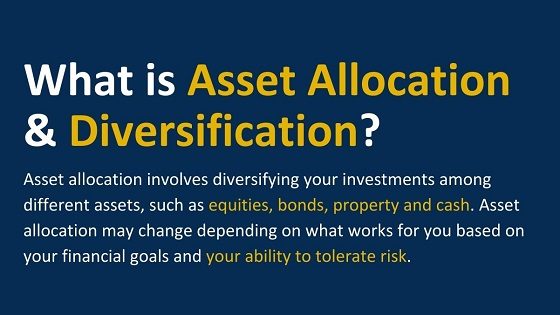

Asset Allocation

https://www.ellisbates.com/wp-content/uploads/2023/02/Asset-Allocation-Infographic-holder.jpg 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=gWhat is asset allocation and diversification? Asset allocation involves diversifying…

read more

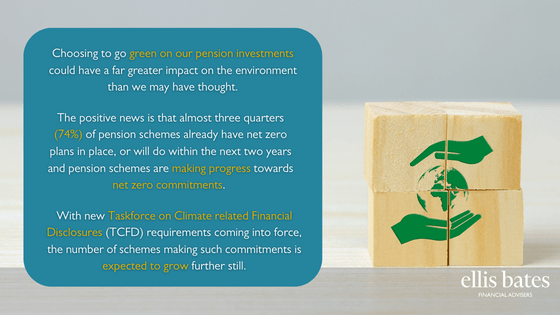

The Conference of the Parties (or COP for short) is the name given to the parties of the United Nations Framework Convention on Climate Change (UNFCCC), which is the world’s largest treaty for addressing climate change. COP is an important platform for nations to discuss and reach consensus on how to protect the world in terms of environmental issues.

The Conference of the Parties (or COP for short) is the name given to the parties of the United Nations Framework Convention on Climate Change (UNFCCC), which is the world’s largest treaty for addressing climate change. COP is an important platform for nations to discuss and reach consensus on how to protect the world in terms of environmental issues.